Zijin Mining (2899 HK): Fully Valued Ahead Of (Expected) Gold Unit Spin-Off

Back on the 30th April 2025, Zijin Mining (2899 HK) said it planned to spin off its overseas gold mine assets on the Hong Kong exchange.

The newly created unit, Zijin Gold International, owns/operates mines in South America, Central Asia, Africa and Oceania, including the Buritica project in Colombia, the nation's largest gold mine.

A Circular is now out concerning the spin-off, which is not subject to shareholder approval. Pegged to peers, Zijin appears fully valued.

The Trade:

A spin-off makes sense as Zijin capitalises on the upward cycle in gold prices.

However, I see Zijin trading at a single-digit discount to NAV.

Before any holding company discount.

This insight is labelled bullish as I'm not bearish here.

The NEW News

A Circular detailing the gold unit spin-off has been dispatched.

Given the size of Zijin Gold relative to its parent, it is not a notifiable transaction according to the Listing Rules, and therefore, no shareholder approval is required.

The spin-off is not a formality, and various regulatory approvals - such as CSRC - are still required.

Timetable? No timetable has been furnished.

Size? The number of new shares to be issued by Zijin Gold will not exceed 15% of issued shares on a fully diluted basis.

15% is the minimum free float (not 25%) as Zijin Gold is expected to have market cap in excess of HK$10bn.

Assured entitlement? Yes, existing Zijin Mining shareholders - H shareholders only, not A shareholders - will be provided with an assured entitlement to the shares in Zijin Gold, subject to a shareholder vote at a (expected) forthcoming EGM.

On Zijin Gold

The assets to be involved in the spin-off consist of eight large-scale gold mines located in South America, Central Asia, Africa and Oceania - full detail of these mines can be found on page 33.

Apart from the Porgera Mine in PNG, Zijin Mining holds a controlling stake in each mine.

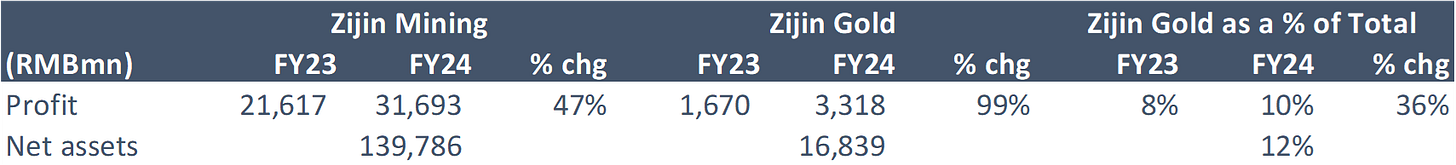

Finances for the spin-off are limited. Zijin Gold's net profit (after non-recurring items) was RMB3.3bn in FY24, up 99% yoy.

As a comparison, Zijin Mining net profit (after non-recurring items) was RMB31.7bn in FY24, up 47% yoy.

Therefore net profit (after non-recurring items) for Zijin Mining, net of Zijin Gold, was RMB28.4bn in FY24, up 42% yoy.

The upshot: Zijin Mining's profit is growing; Zijin Golds's are growing faster. But remain a smallish % of the overall group - ~10% of group profit.

Keep reading with a 7-day free trial

Subscribe to Hong Kong/China M&A/Events to keep reading this post and get 7 days of free access to the full post archives.