StubWorld: Swire Pac's NAV Discount Widens. Bs Outperform As

As Swire Pacific (A) (19 HK) plumbs new 12-month lows for its NAV discount and implied stub, Swire's B shares have significantly outperformed the As over the past month.

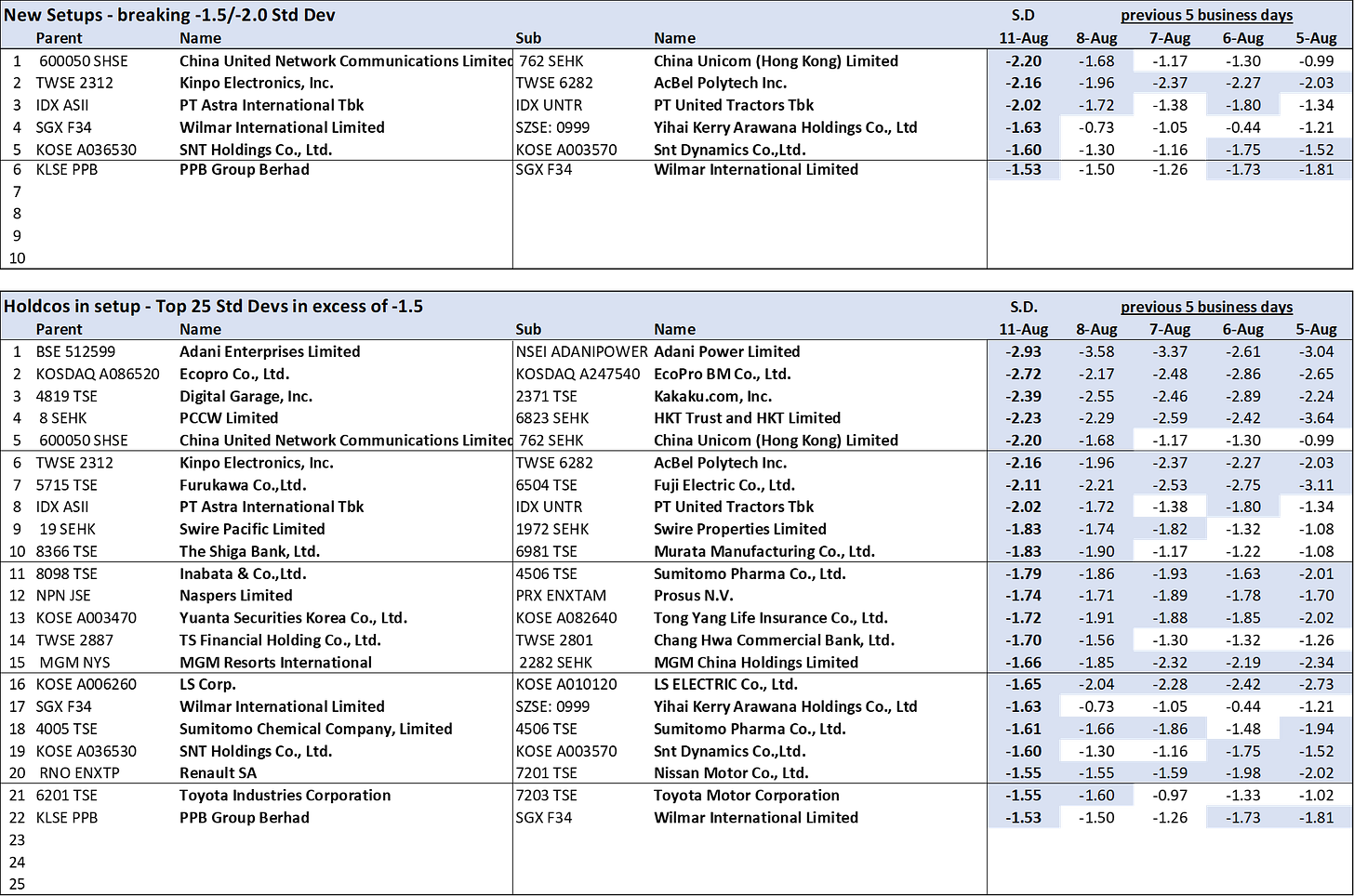

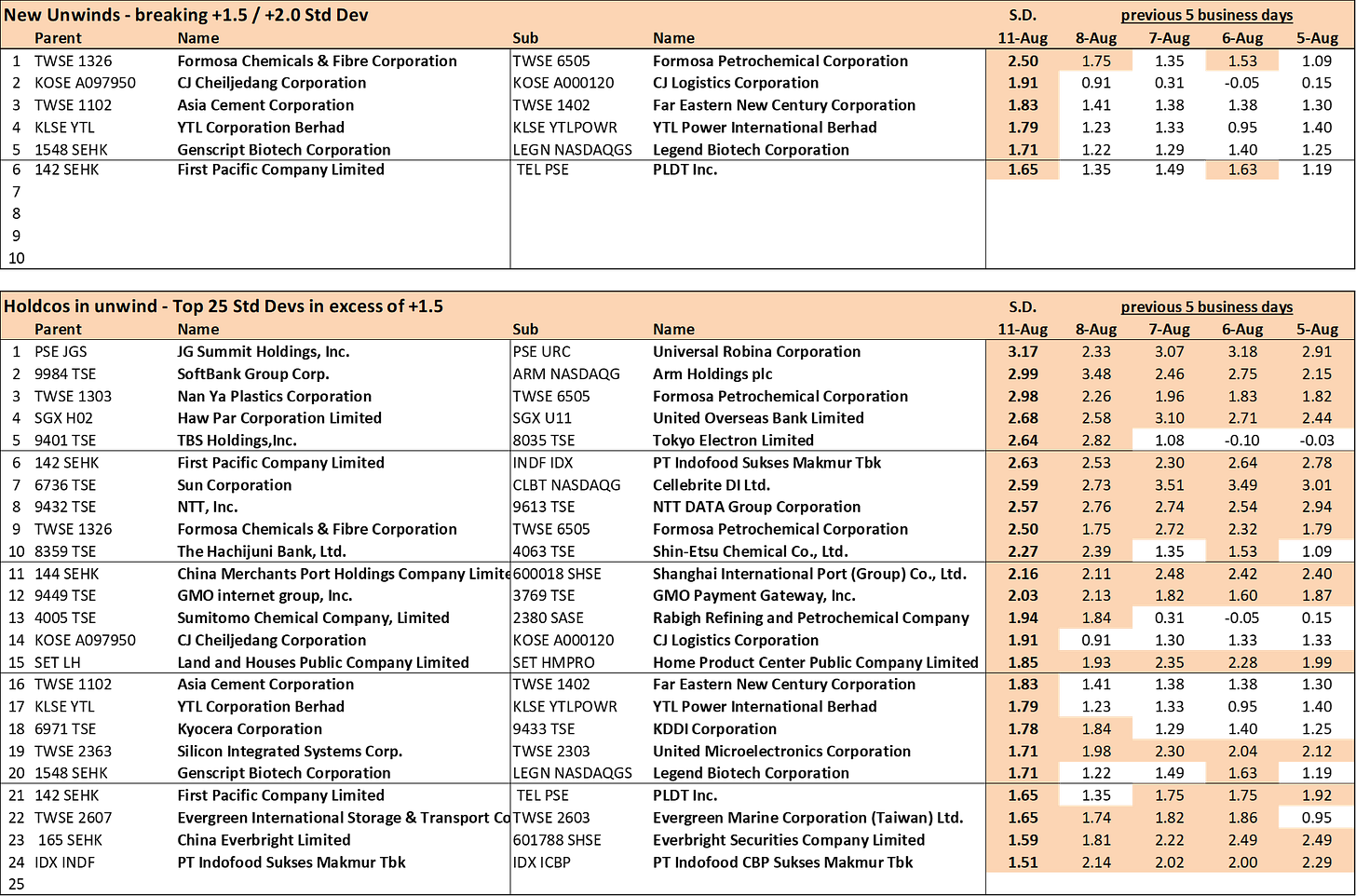

Preceding my comments on Pac, Swire Properties (1972 HK) & Cathay Pacific Airways (293 HK), are the current setup/unwind tables for Asia-Pacific Holdcos.

These relationships trade with a minimum liquidity of US$1mn, and a % market capitalisation >20%.

Swire Pacific (A) (19 HK)/Swire Properties (1972 HK)/Cathay Pacific Airways (293 HK)

Full-year results for Pac and Prop were both announced on the 7th August - see here and here. Cathay's were released on the 6th August - see here.

Pac's deconsolidated EBITDA was HK$3.8bn, up from HK$2.1bnn in 1H24. It was HK$3.3bn in FY24.

Cathay, on a 100% basis, recorded a profit of HK$3.65bn in the 1H25 vs. a profit of HK$3.6bn (including exceptional gains of HK$109mn) in 1H24 - and why you see "share of profits of associated companies" of HK$1.65bn on page 46 for Pac's 45% share.

The wild card is the valuation of the beverage division which made HK$2.5bn of EBITDA in the 1H25 vs. HK$2.2bn in 1H24.

It generated HK$5bn of EBITDA in FY24, and the second half generally exceeds the first half.

1H25 net debt at the parent level after deconsolidating out Swire Prop was HK$34.7bn compared to HK$32.7bn as at 31st Dec 2024.

I estimate Swire is trading at a 47% discount to NAV against a one-year average of ~37%.

Keep reading with a 7-day free trial

Subscribe to Hong Kong/China M&A/Events to keep reading this post and get 7 days of free access to the full post archives.