StubWorld: PCCW's Tenacious NAV Premium

Despite the recent pullback, PCCW Ltd (8 HK) continues to trade at an unjustifiable premium to NAV.

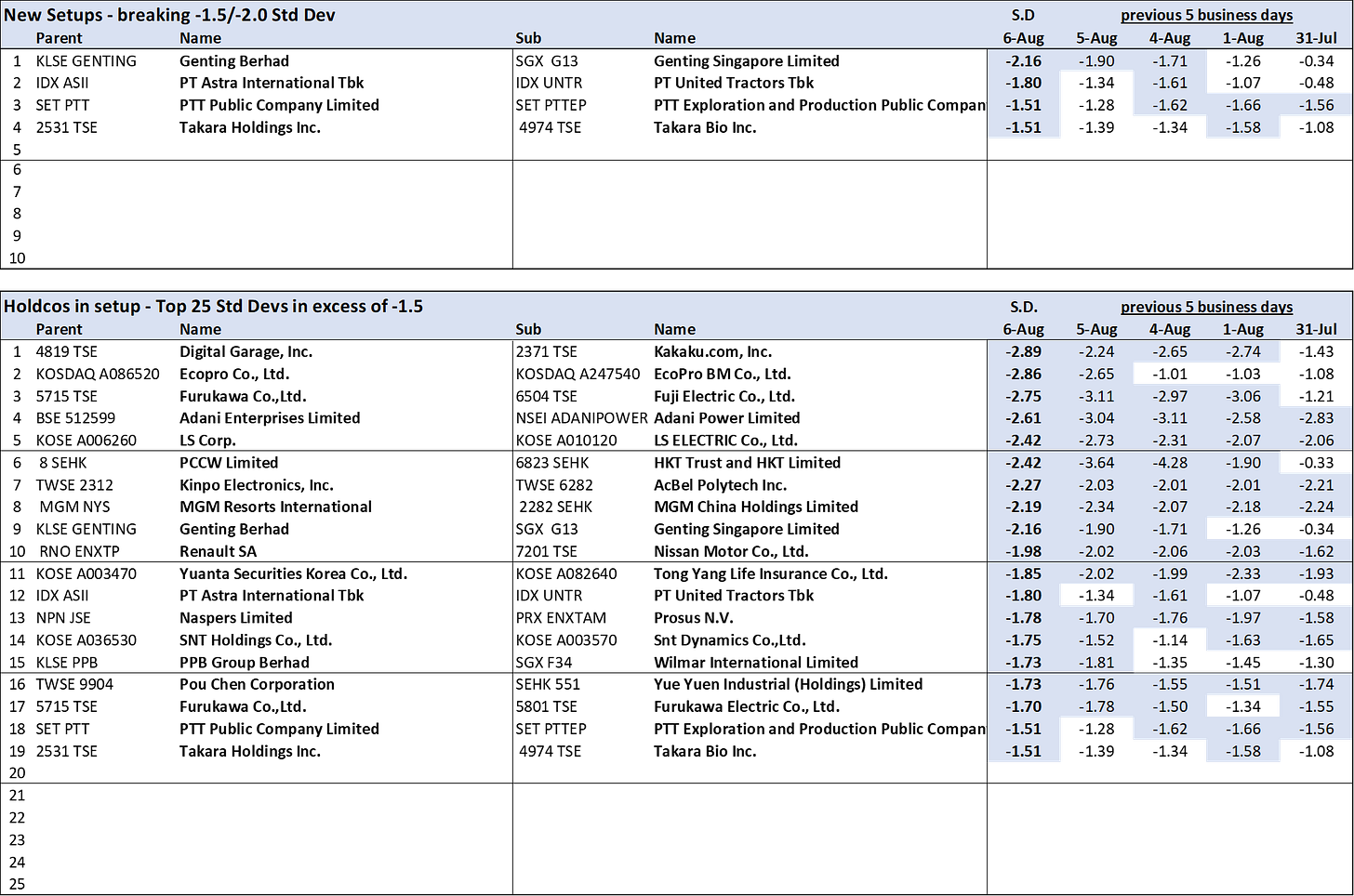

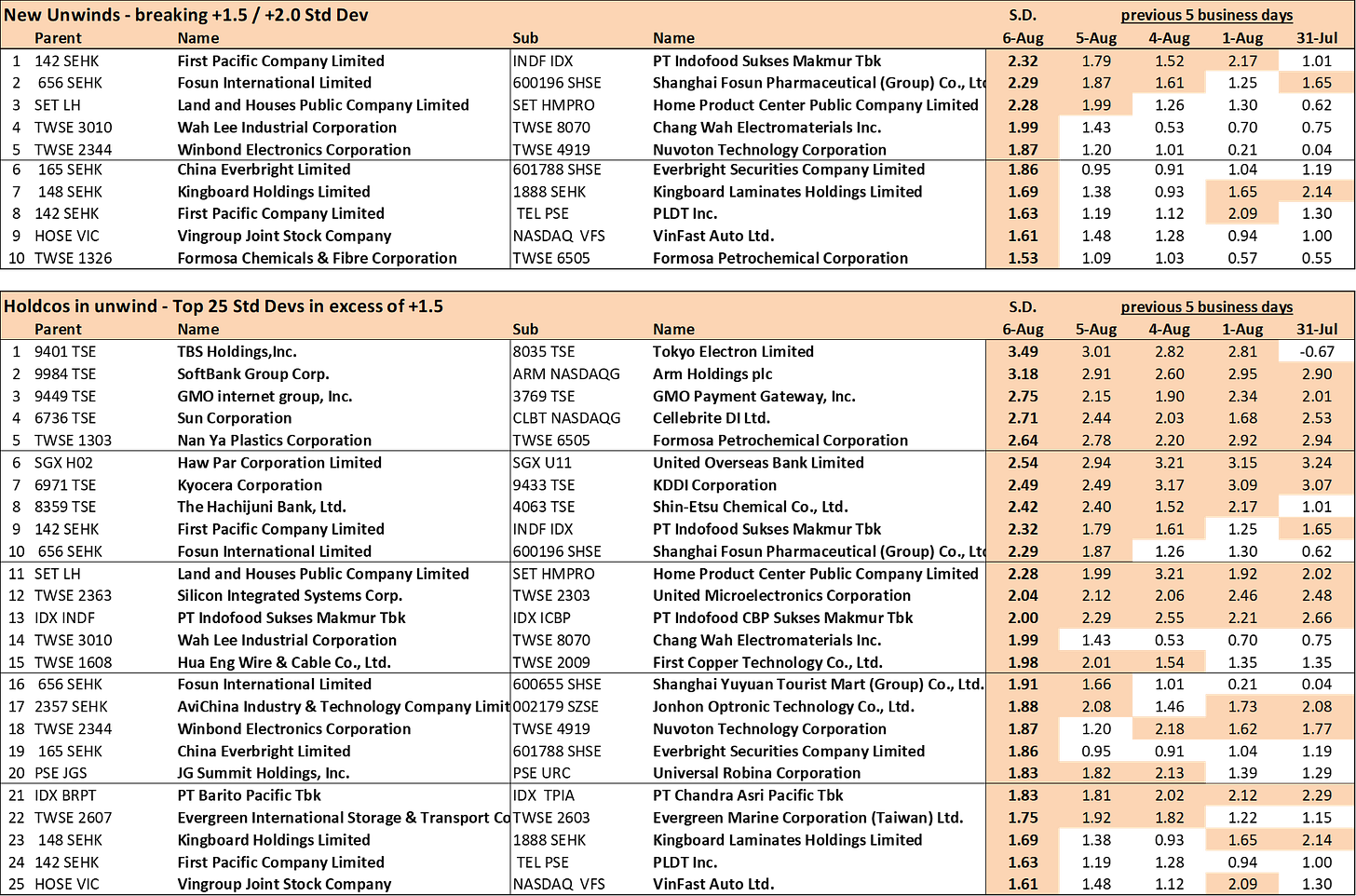

Preceding my comments on PCCW/ HKT Ltd (6823 HK) are the current setup/unwind tables for Asia-Pacific Holdcos.

These relationships trade with a minimum liquidity of US$1mn, and a % market capitalisation >20%.

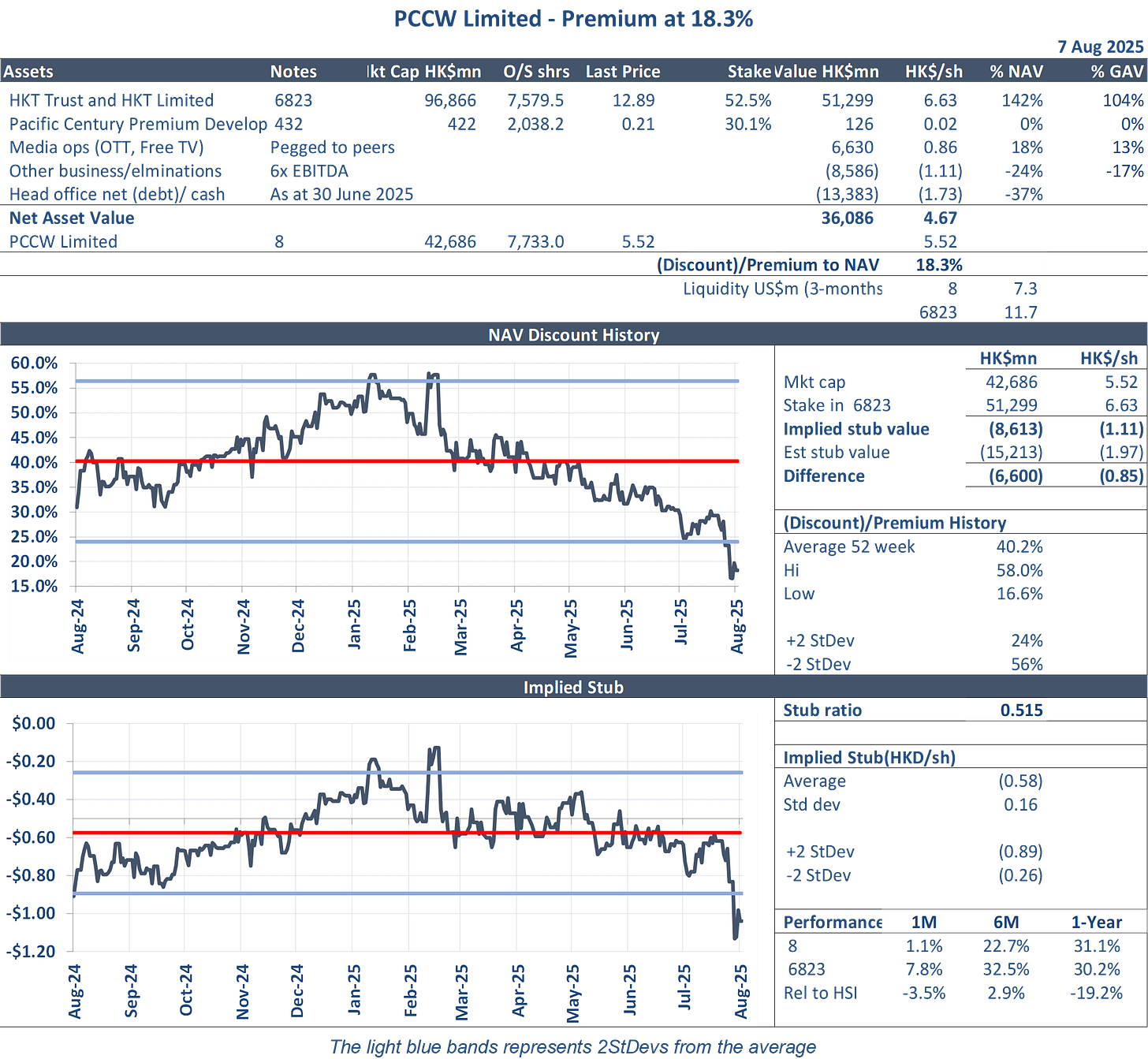

PCCW Ltd (8 HK) / HKT Ltd (6823 HK)

I see PCCW's premium to NAV at ~18%, compared to the 12-month average premium of ~40%.

I estimate deconsolidated net debt of HK$13.4bn (HK$1.73/share, excluding leases) as at 30th June 2025, compared to HK$10.2bn as at 31st December 2024, and HK$9.5bn as at 30th June 2024.

The 52.5% stake in HKT accounts for 120% of PCCW's market cap.

Source: my estimates, PCCW, CapIQ

Keep reading with a 7-day free trial

Subscribe to Hong Kong/China M&A/Events to keep reading this post and get 7 days of free access to the full post archives.