StubWorld: Melco (200 HK) Needs To Fall

Melco International Development (200 HK)'s fully-paid rights shares commence trading today. Melco is down just ~14% since announcing a one-for-two rights issue; and 13% above the TERP.

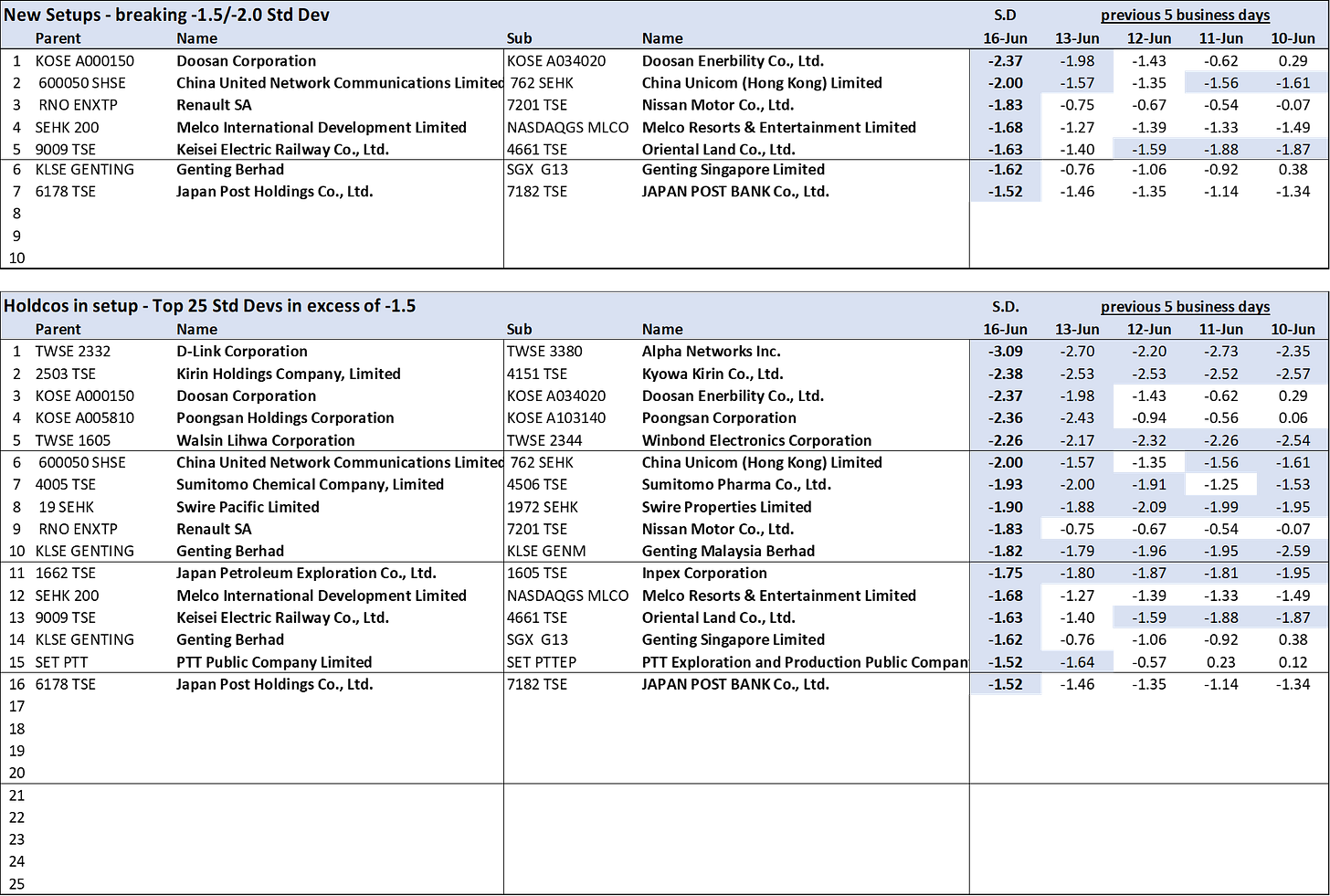

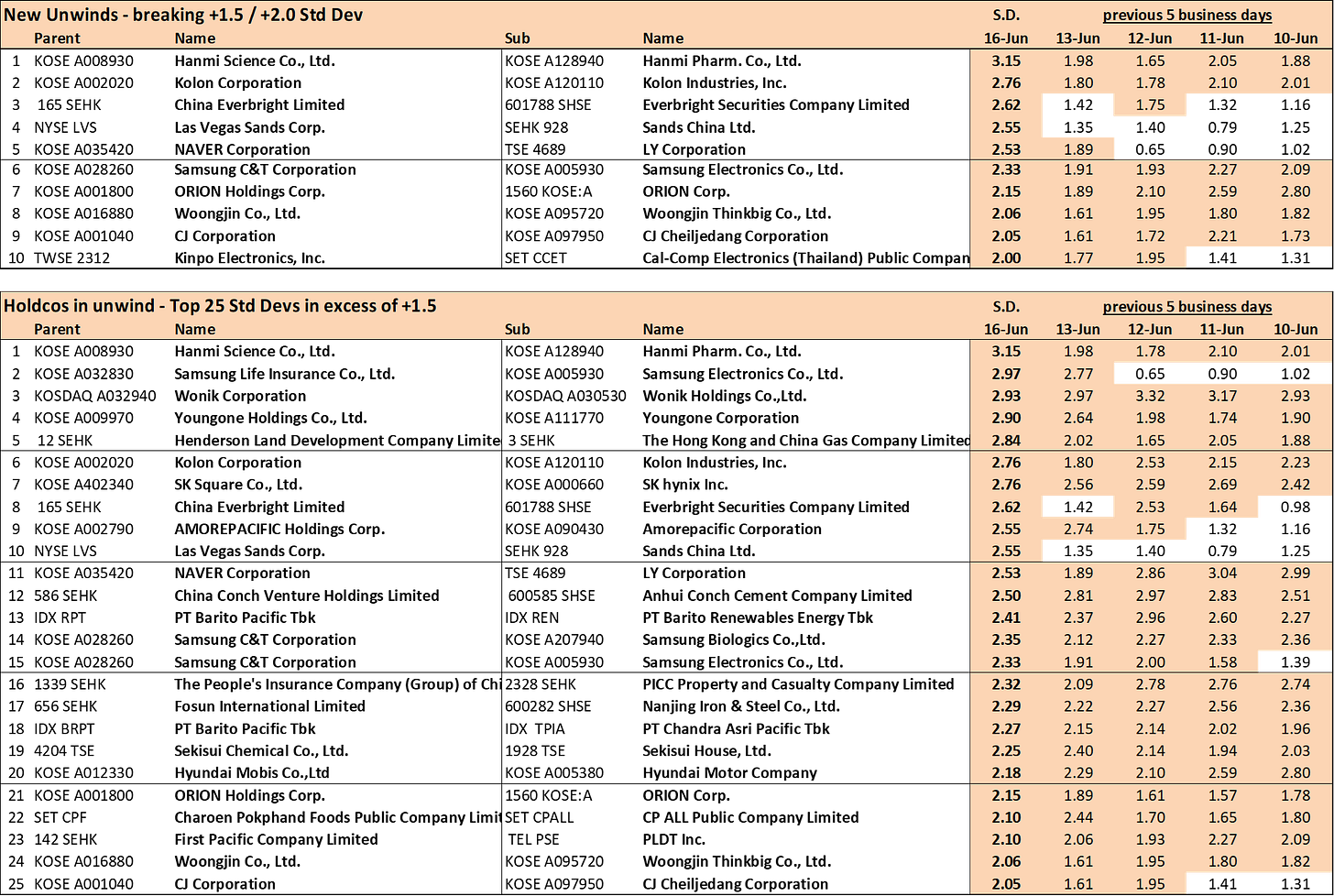

Preceding my comments on Melco are the current setup/unwind tables for Asia-Pacific Holdcos.

These relationships trade with a minimum liquidity of US$1mn, and a % market capitalisation >20%.

Conclusions

Melco appears somewhat inexpensive, relative to peers, using CapIQ figures. But this before factoring in the share dilution from the rights issue.

I would also question that TERP price of HK$2.88/share, as shares gained 11.1% the week heading into the rights announcement.

Lawrence's stake in Melco remains relatively static, post rights, at 61.37% versus 61.44% previously. So nothing gained, in terms of chipping away at minorities, from the rights.

The Trade:

Melco has largely swatted away a significant share dilution.

I see the NAV discount at 9% after incorporating the rights and the rights proceeds. Way too tight.

Melco's relative strength in the face of the rights may have been short related.

I think Melco needs to decline from here.

Pushback? Gaming peers are up 11%, on average, since Melco announced the rights.

Keep reading with a 7-day free trial

Subscribe to Hong Kong/China M&A/Events to keep reading this post and get 7 days of free access to the full post archives.