StubWorld: CKH (1 HK) - Expect Near-Term Weakness If Exclusivity Ends Without Resolution

CK Hutchison Holdings (1 HK)'s delicate dance continues as it juggles U.S and Beijing politics; and its fiduciary duty to shareholders, as the Blackrock exclusivity long stop date looms.

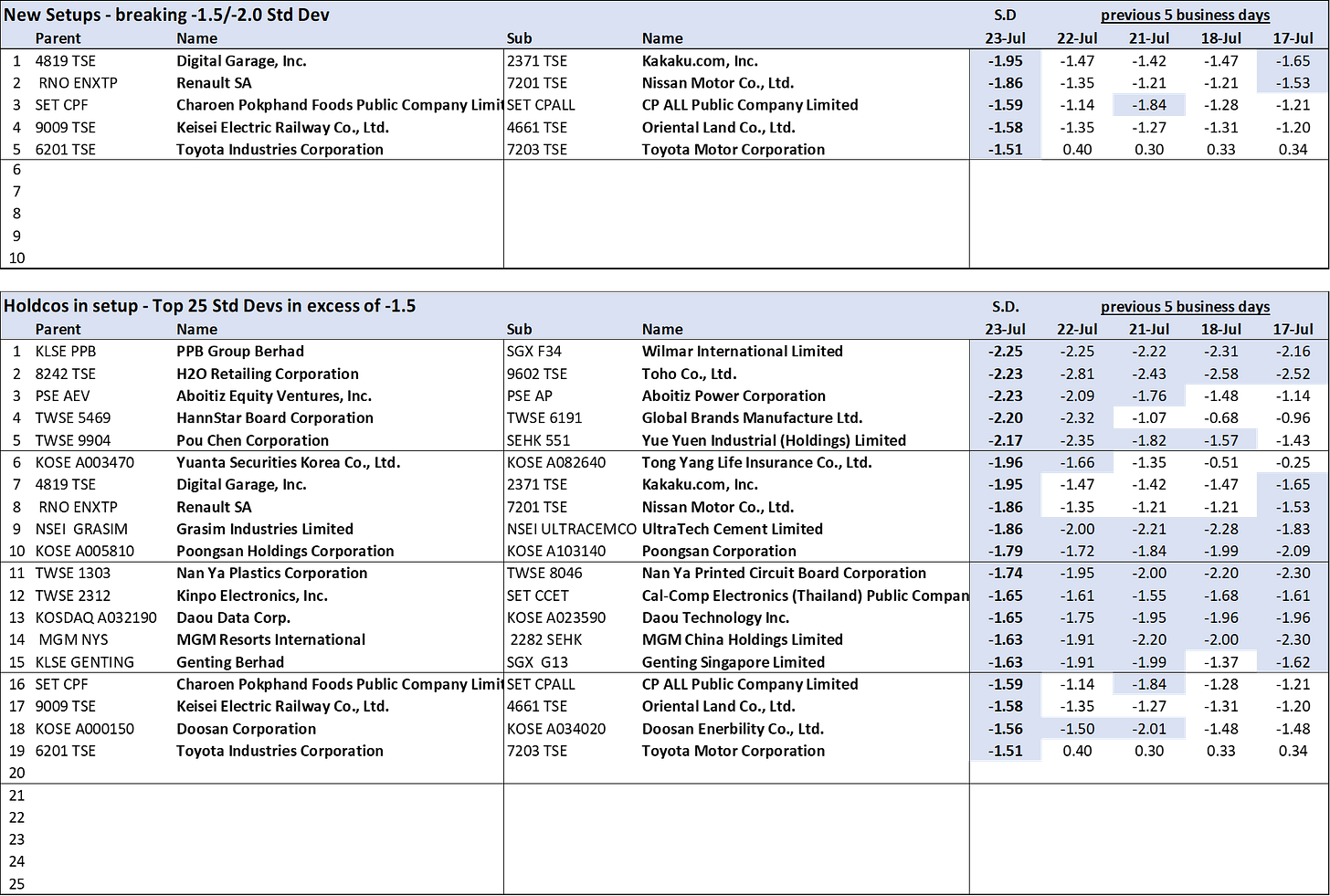

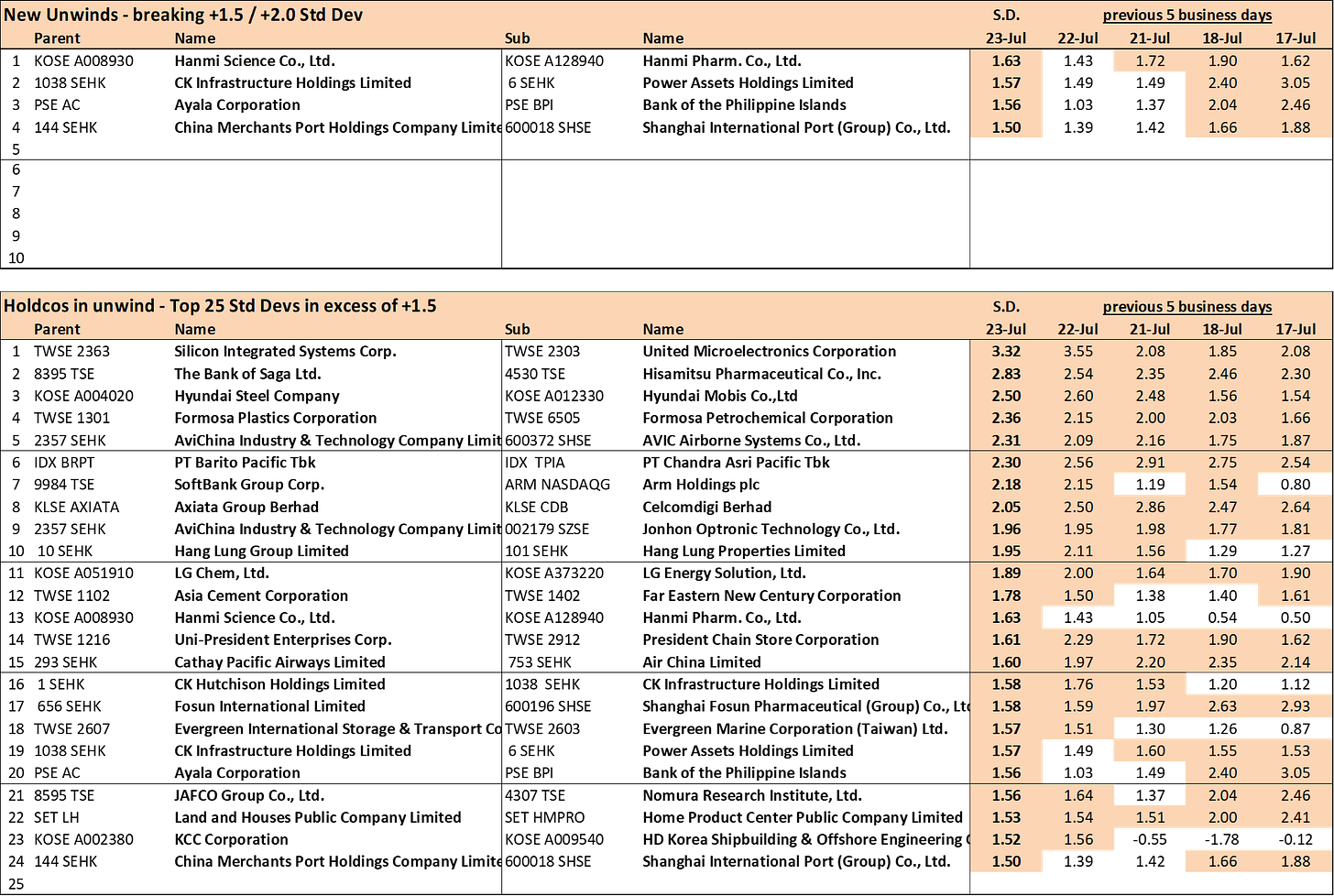

In a double dose of StubWorld this week, preceding my comments on CKH - and CK Infrastructure Holdings (1038 HK) - are the current setup/unwind tables for Asia-Pacific Holdcos.

These relationships trade with a minimum liquidity of US$1mn, and a % market capitalisation >20%.

What's New?

Not a lot. When CK Hutchison Holdings (1 HK) announced the port transaction with Blackrock on the 4th March, an exclusivity period of 145 days was agreed. That period expires on the 27th July.

For a fleeting moment, my insight StubWorld: Cheung Kong's Geopolitics prior to the transaction was timely (and a useful background check). Until it wasn't (CK Hutch (1 HK): Back To Square One).

The laundry list of issues muddying a deal closure are abundant. A few that have caught my eye in the past few months include:

28-Mar-25: The Diplomat article discusses (alleged) Beijing’s public pressure campaign against CK Hutchison;

26-Mar-25: This Bloomberg video in which Christopher Hui's (Hong Kong secretary for financial services and the treasury) addresses concerns (at around the 5.40 mark) over whether Beijing's ire over CK Hutchison's Panama port deal would affect Hong Kong's financial services sector;

20-Mar-25: The Economist article (paywalled) suggesting Beijing won't block the deal. (But can they?);

18-Mar-25: The New York Time article (paywalled) on Hong Kong Chief Executive John Lee joining the criticism over CK Hutch's sale of ports;

18-Mar-25: The WSJ article (paywalled) that "Beijing is aware that any significant effort to torpedo the deal risks escalating tensions with the Trump administration";

7-Apr-25: Panama's Comptroller-General Anel Flores announced that an audit had found “many breaches” of the concession awarded to CK Hutchison to operate the Balboa and Cristobal ports;

27-Apr-25: SAMR warning CK Hutchison and buyers against bypassing antitrust reviews.

Recent reports appear to rehash older articles.

What appeared a smart, nuanced deal - bundling the controversial two ports straddling either side of the Panama Canal with 41 other ports - is now mired in geopolitics and national interest.

What happens if the exclusivity expires and no deal?

Expect some weakness in CKH.

It's not as though Blackrock and the Aponte family’s MSC Mediterranean Shipping Company (MSC) can't agree on pricing.

You could see the exclusivity period being extended (less likely), an announcement that despite the exclusivity ending, negotiations remain positive and ongoing (likely); or Blackrock/MSC walk (also likely).

Keep reading with a 7-day free trial

Subscribe to Hong Kong/China M&A/Events to keep reading this post and get 7 days of free access to the full post archives.