STAR CM (6698 HK): Grave Accusations

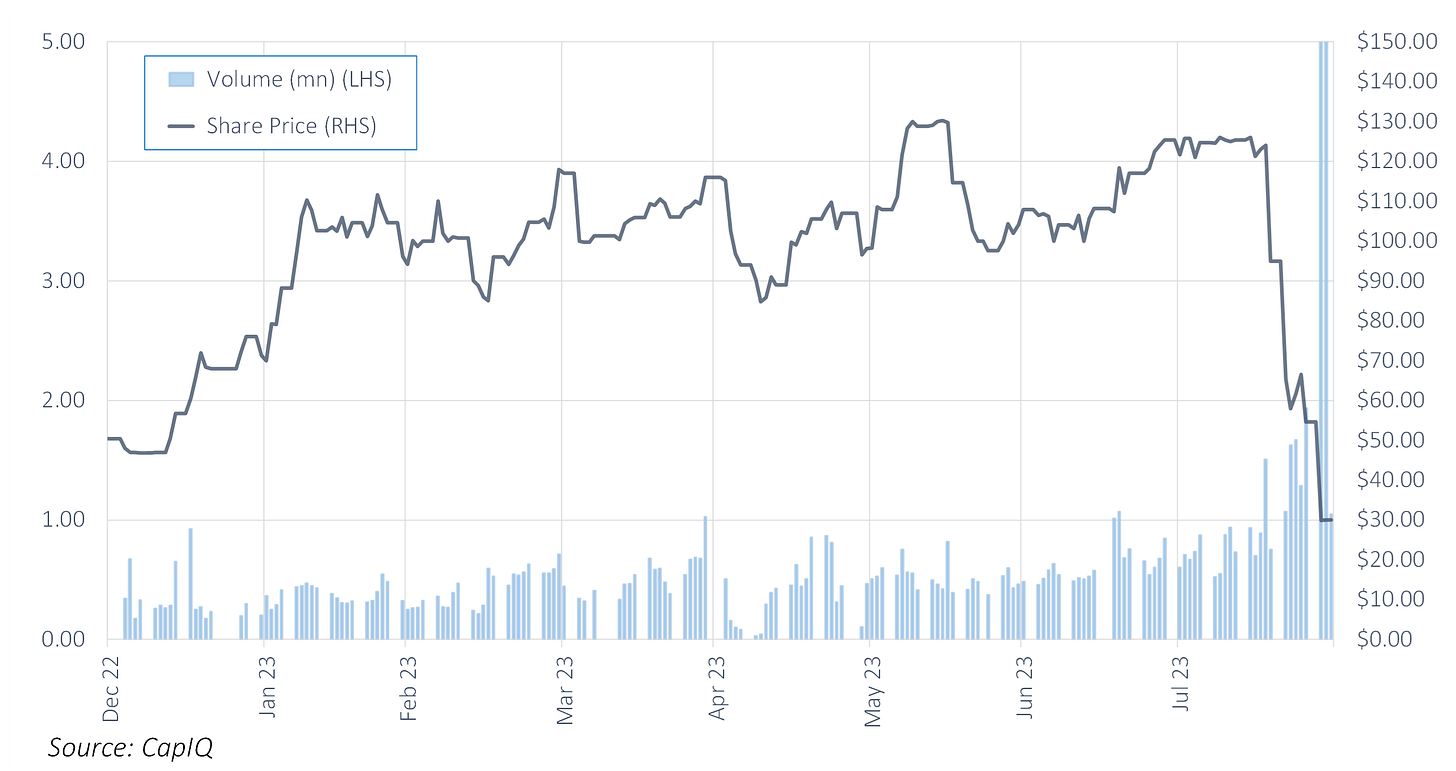

STAR CM Holdings (6698 HK), a variety program intellectual property creator and operator, was listed last December and promptly gained 475% by early August. All good so far.

Shares cratered on the 18 August (-23.4%) and are currently 76% adrift from its recent high. The reason? A viral clip from late pop diva Coco Lee discussing unfair treatment.

The music competition show, in which Coco appeared, pushed back on any impropriety; however, its broadcaster has temporarily suspended the program. This is no easy fix.

Some Background

On Coco Lee. For readers not living in this region, the popularity of Coco cannot be overestimated.

She had been active in the music industry for nearly three decades, and was the first Chinese singer to break into the American market, the first Chinese American to perform at the Academy Awards, among a host of other firsts.

Her passing on the 5 July at the age of 48 was BIG news.

Even bigger news was the ill will leveled against her husband Bruce Rockowitz (ex-CEO of Li & Fung Ltd (494 HK) and Global Brands Group Holding (787 HK)) after her passing, though this has nothing to do with CM Star.

It was all very sordid. And sad.

On Sing! China. This is a music competition show broadcasted by Zhejiang TV and produced by STAR CM. It is the Chinese version of the international reality television singing competition franchise The Voice.

In the leaked audio clip (by whom?), Coco addressed her experience with the production team in 2022, alleging (amongst other matters):

a disagreement with the show’s competition format, which eliminated contestants without assigning scores. She advocated for fairness but faced resistance from the program.

on the final day of recording on October 14th, Coco complained of numbness and loss of warmth in her left leg ( Lee was born with an abnormality in her leg). However, the production team denied her request to have a guest artist stand by her side for support.

The related Weibo hashtag “Leaked Recording of Coco Lee Denouncing ‘Voice of China’ Before her Death” has received almost 3bn views.

Other stars on the show came out in support of Coco's comments - only for such comments to be expunged, and the stars to subsequently apologise for the misunderstanding.

Which, on the surface, was not a great look.

Sing! China issued a statement on August 17 stating "some self-media accounts have spread maliciously edited audio clips regarding Coco Lee denouncing ‘The Voice of China’ before her death".

STAR CM noted on the 25 August that" Zhejiang Satellite TV Station, being the primary broadcasting platform of the Company’s variety program “Sing! China”, had announced today the temporary suspension of broadcasting the program, pending further investigation into certain incidents revealed in recent media reports."

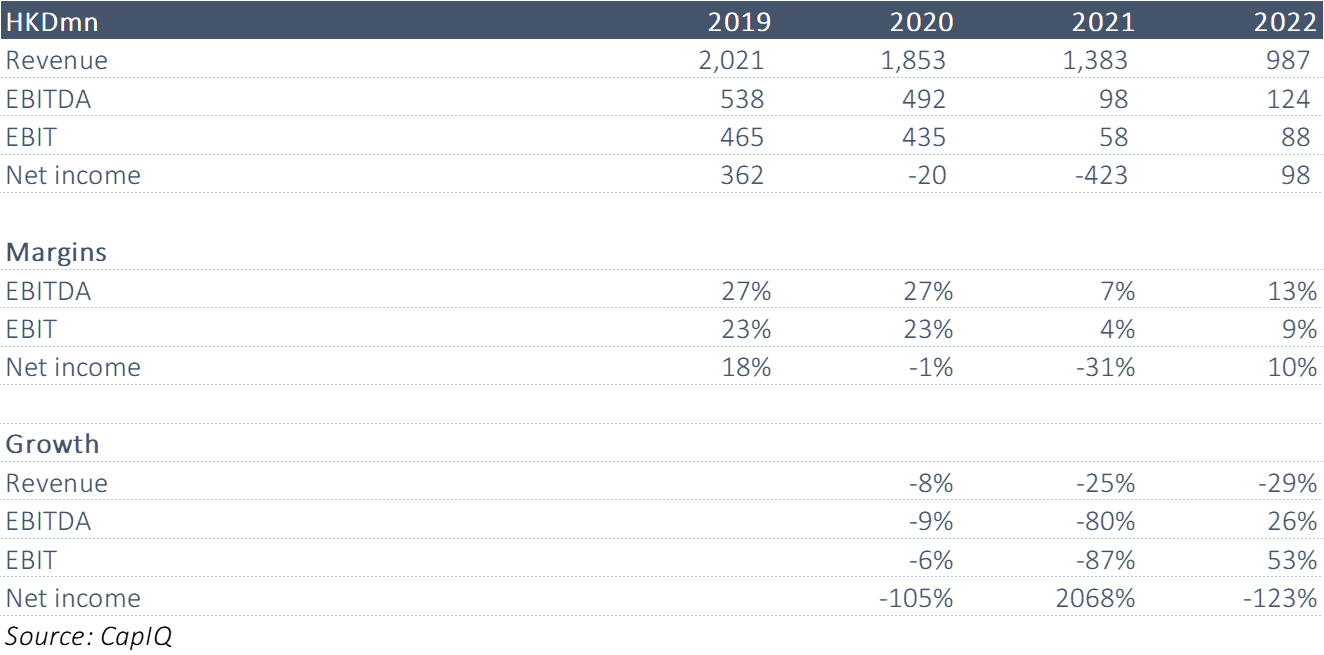

Profit warning. Star CM announced a profit warning on 2 August, in which it expects an adjusted net loss of RMB18.3mn to RMB14.6mn in the 1H23, compared to a loss of RMB6.3mn in 1H22.

The share price swatted the news away.

The net loss was RMB17.2mn.

How big a deal is Sing! China to STAR CM? Big. It accounted for 28.6% (see page 6) of revenue generated from variety program IP production, operation, and licensing in 2021.

We don't know the number in 2022, only that it was STAR CM's " major revenue contributor" (see page 14).

On STAR CM

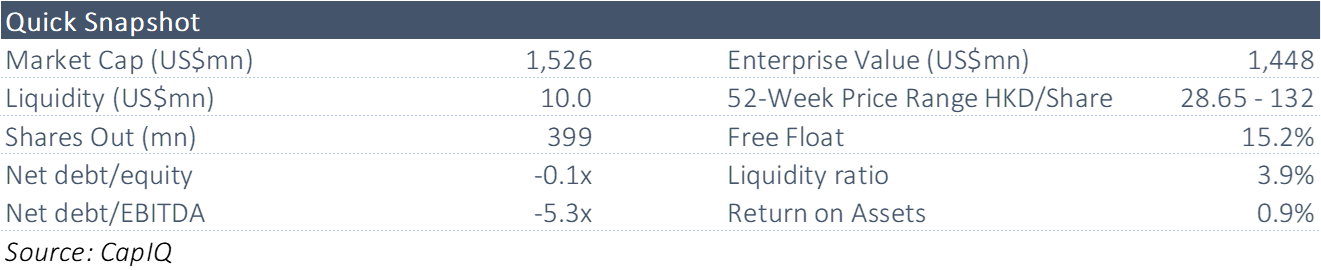

STAR CM is the largest variety show IP creator and operator in China in terms of revenue in 2021.

The company owns and operates a large library of Chinese film IPs, and is a music IP creator and operator in China.

STAR CM has produced a number of variety programs in China, including the competition show “Street Dance of China” in addition to “Sing! China”.

STAR CM was listed on the 29 December 2022 at HK$26.50/share. Here is the prospectus.

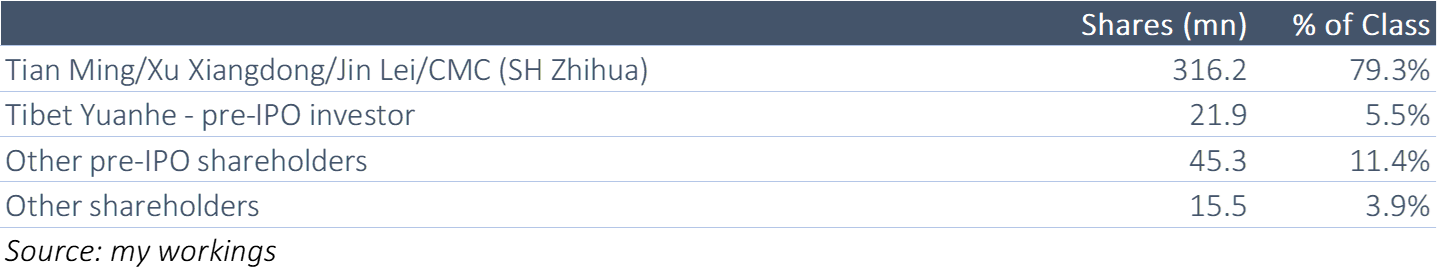

Shareholder Register

On that controlling shareholder collective:

Tian Ming is an Executive Director, chairman of the Board, and chief executive officer;

Xu Xiangdong is an Executive Director;

Jin Lei is an Executive Director; and

CMC stands for Chinese Culture (Shanghai) Equity Investment Center (L.P.) and Chinese Culture (Tianjin) Investment Management Co., Ltd, both of which control Shanghai Zhihua Enterprise Management Partnership.

A more detailed overview can be found on page 182 of the prospectus.

Lock-ups. Shares held by the Controlling Shareholders are subject to certain lock-up periods. See page 17.

A cornerstone investor (0.37%) has agreed that it will not dispose of any shares during the period of 12 months from the Listing Date

The pre-IPO Investors are also subject to a 12-month lock-up requirement.

Float? As STAR CM's market cap is >HK$10bn, it received SEHK dispensation to have a public float between 15-25%. See page 111.

Pre-IPO Investors are considered to be part of the float.

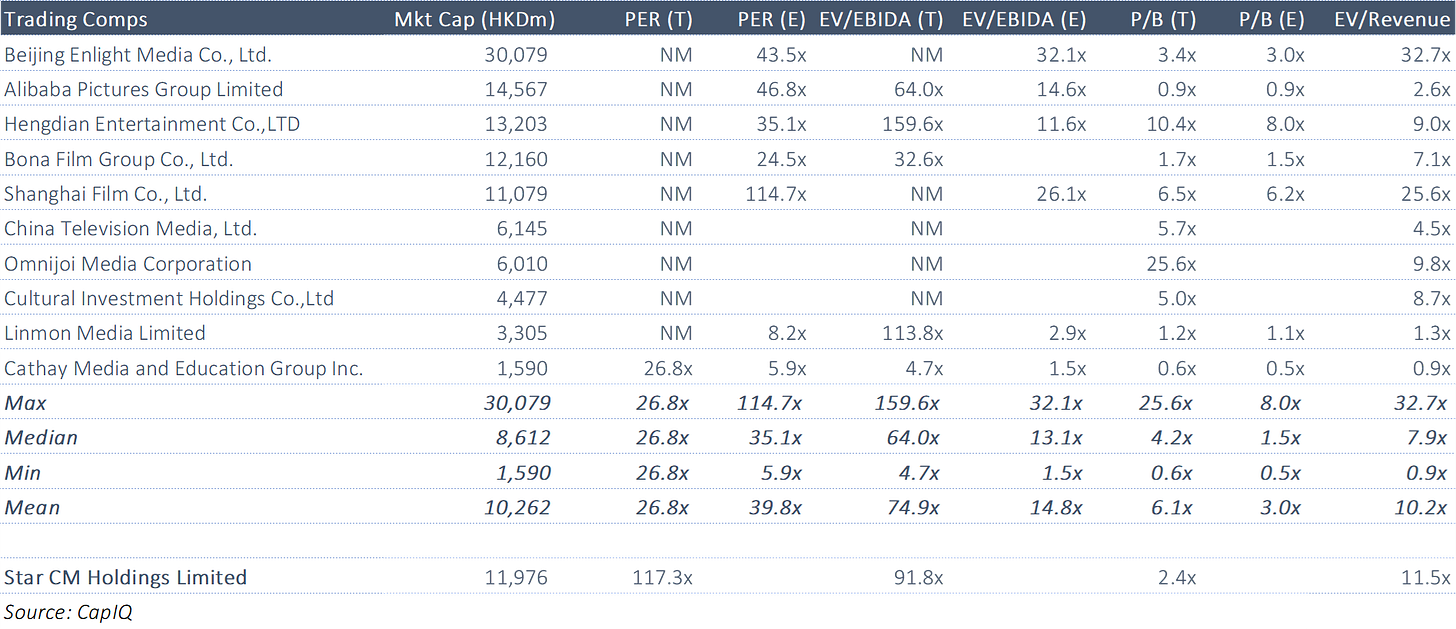

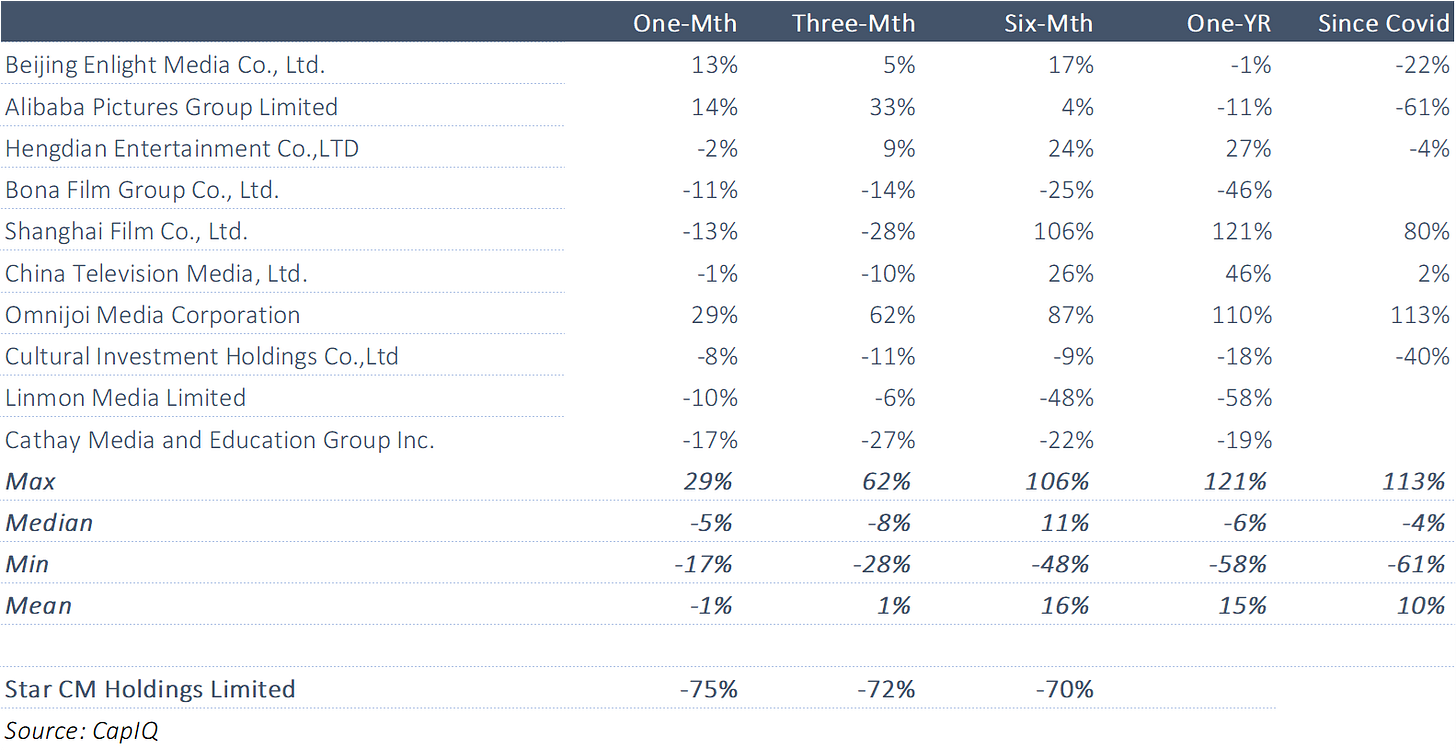

STAR CM vs. Peers

STAR CM appears expensive on any metric.

Price Performance

STAR CM is trading back down towards its IPO price.

Not altogether surprisingly, STAR CM is one of the worst performers over the past six months.

Anything Else? Shorts & Connect

STAR CM is on the designated short-selling list (added on the 5 May) but no shares are currently short.

Just 0.18% and 0.11% of shares out are held via the Shanghai and Shenzhen Connect programs respectively.

Conclusion

When China's internet watchdog was censoring top influencers in late 2021, it said individuals or private firms must abide by the law and ‘vigorously promote core socialist values’.

This is not the first black mark for Zhejiang TV (which is one of the five big satellite TV networks in China) after facing criticism in the death of actor Godfrey Gao back in 2019; and the drowning of an assistant during the making of another show in 2013.

This latest development calls into question the broader Chinese entertainment industry, and how it strikes a balance between viewership/profitability and ethical boundaries.

For STAR CM, this is a material setback.

One wonders what the company's spin will be to say everything is back on track. It will take some convincing. All the while, STAR CM is loss-making. Avoid