Soundwill (878 HK): Thoughts On The Latest Scheme Fail

After Goldlion (533 HK)'s spectacular Scheme fail, Soundwill (878 HK) appeared destined to be the next failure as shares dipped hard ahead of the Scheme vote. And fail it did.

Just like for Goldlion, Soundwill's Offer was clearly light. The counter-argument was that terms were, arguably, as good as it gets. And no competing Offer would emerge. Minorities voiced otherwise.

Hong Kong has been the proverbial graveyard for arb deals of late. However, in a positive sense, minorities in Goldlion and Soundwill simply rejected opportunistic Offers.

The NEW News

Bermuda-incorporated Soundwill Holdings (878 HK)'s privatisation attempt has been voted down by independent Scheme shareholders.

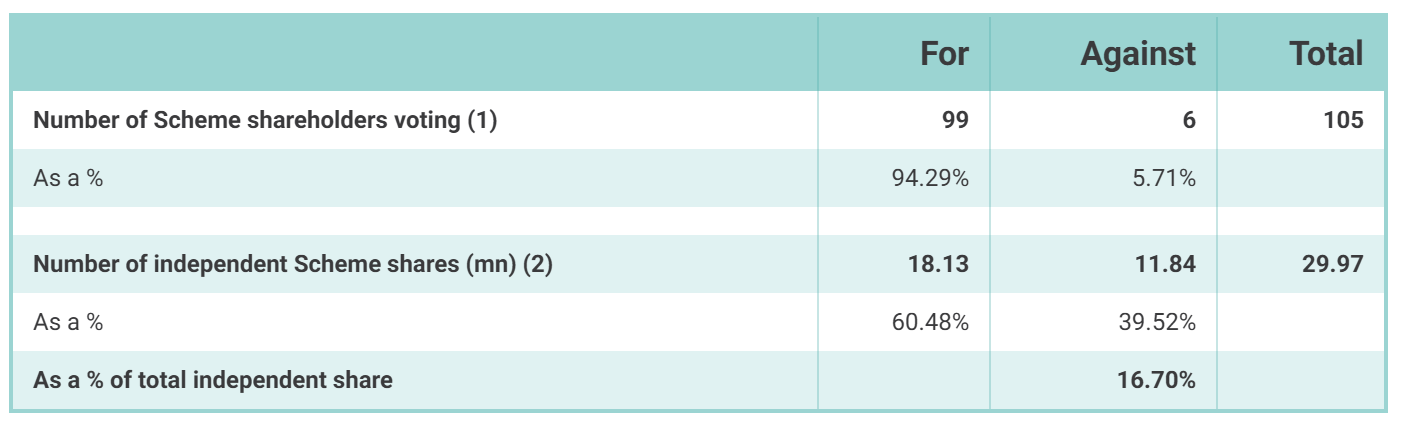

(1) - If looking through to CCASS participants, that number changes to 117 For and 16 Against.

(2) - This represents 16.70% of total independent scheme shareholders entitled to vote.

The number of votes cast FOR the resolution (60.48%) to approve the Scheme by the independent Scheme shareholders was less than 75% of the votes present and via proxy; and the number of votes cast AGAINST the resolution (16.70%) to approve the Scheme by the independent Scheme shareholders was more than 10% of the votes attaching to ALL Scheme shares held by the independent Scheme shareholders.

FWIW - Soundwill's passed the headcount test

To better understand the "look-through" process for the headcount, please refer to: Chinese Estates (127 HK): Understanding The Scheme Voting.

Keep reading with a 7-day free trial

Subscribe to Hong Kong/China M&A/Events to keep reading this post and get 7 days of free access to the full post archives.