Sipai Health Technology: Hidden Benefits, Not-So-Hidden Risks

Sipai Health Technology (314 HK), a Chinese digital healthcare platform backed by Tencent (700 HK) continues to eke out new highs.

Sipai closed up 34% on its debut two days before Xmas last year, and is currently up 74% on its IPO price of HK$18.60.

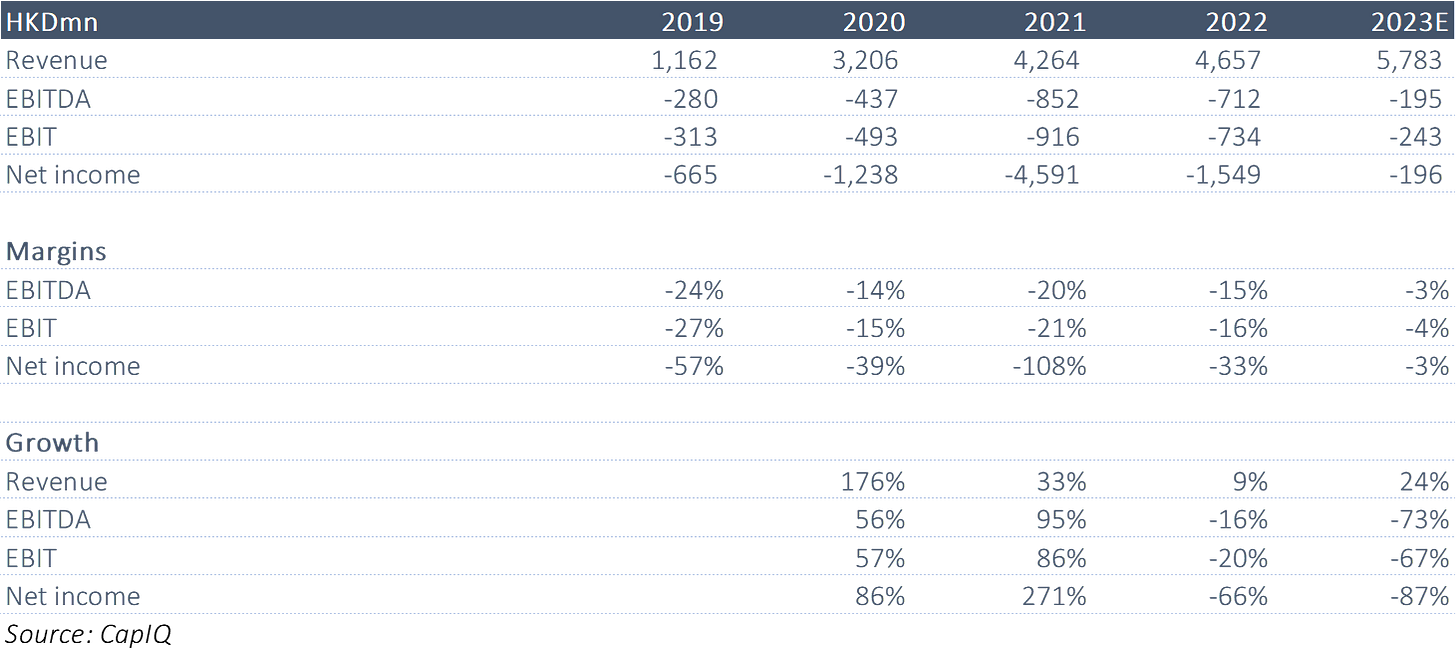

The company is loss-making. However, FY22 financials showed those losses continue to fall.

On Sipai

Sipai was IPOed on the 22 December at HK$18.60. Here is the prospectus.

Sipai runs three business lines:

Specialty pharmacy business. As of December 31, 2022, Sipai operates 96 specialty pharmacies across all provincial administrative regions in mainland China except Xizang and Qinghai.

The pharmacies specialize in prescription medicines for cancer and other critical diseases.

Market share is estimated as 7%, making it the largest privately owned specialty pharmacy in China, as measured by specialty medicine revenue.)

Physician research assistance. Sipai engages in site management organization (SMO) business to support pharmaceutical companies in their drug R&D process from phase I to phase IV oncology clinical trials.

Currently, the SMO business contributes the majority of the physician research assistance revenue.

For the SMO business, Sipai ranks first in the oncology SMO market in China, as measured by revenue in 2021, with a market share of approximately 5.5%.

The total market share of the top five SMO companies is estimated to account for 25-30% of the market in terms of revenue, indicating the top five are not dissimilar in size.

Health insurance services. As of December 31, 2022, Sipai's health service provider network connected over 1,200 Class III Grade A hospitals, 55,000 doctors, and 500 physical examination institutions in over 150 major cities across China.

In 2021, Sipai's market share in terms of premium size in the overall health insurance market in China is estimated to be 0.1%.

Sipai relies on a limited number of state-owned distributors as suppliers of medication, which is a common practice for the specialty pharmacy business in China.

The drug distribution industry in China is highly concentrated, with the top three state-owned drug distributors taking an aggregate market share of over 40% in the entire drug distribution market.

For the six months ended June 30, 2022, Sipai's top five customers accounted for 7.3% of total revenue. Revenue from its largest customer accounted for 2.4% of total revenue.

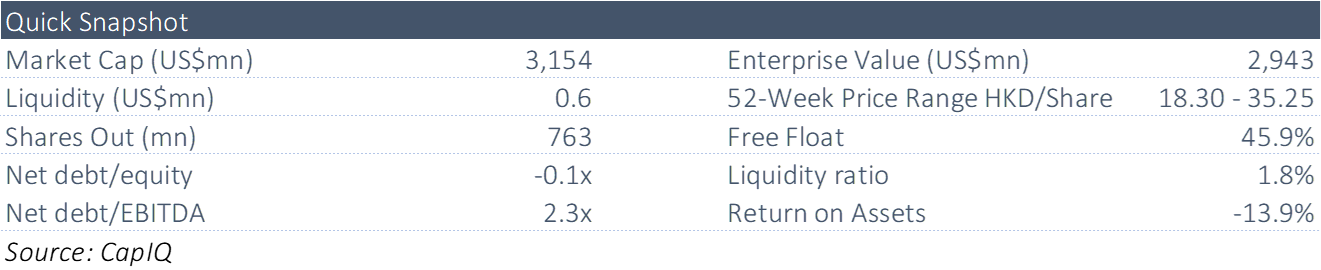

Abridged Financials

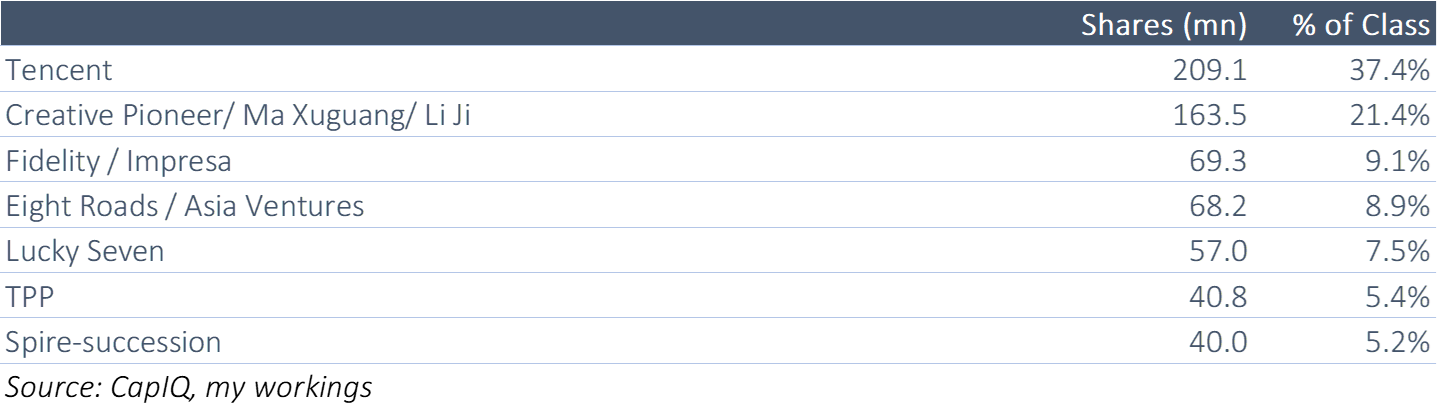

Shareholder Register

Tencent was involved in the series B financing in 2016 and the series E financing in 2021.

Ma and Li co-founded the company in 2014.

Impresa and Eight Roads were pre-IPO investors. Pre-IPO investors held 30.4% on the first day of trading.

Lucky Seven is ultimately controlled by Ma.

TPP is controlled by Tencent.

Spire is controlled by Li.

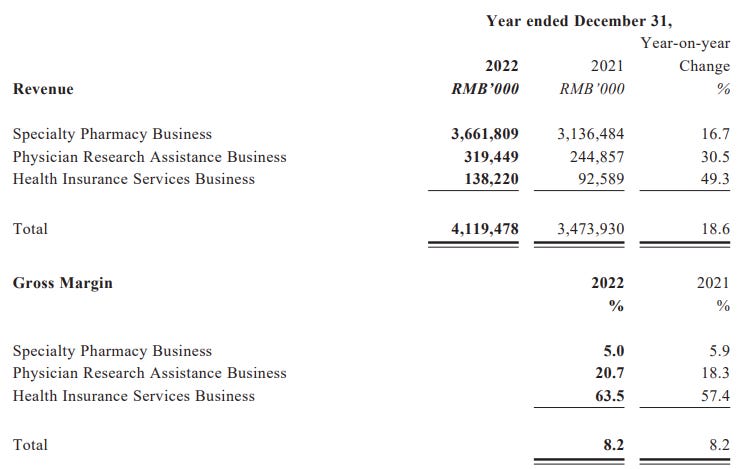

Recent Results - Further Comment

Sipai's loss in FY22 of RMB1.37bn (RMB3.75bn in FY21), is mainly due to the fair value loss on convertible redeemable preferred shares.

Like for like, net of these losses in each year, the adjusted loss was RMB 259mn versus a loss of RMB 365mn in FY21.

The 1H22 adjusted loss was RMB 116mn versus a loss of RMB 143mn in the 1H22, and a loss of RMB 192mn in 1H21.

Fair value changes of convertible redeemable preferred shares represent the gains or losses arising from the change in fair value of issued Series A, Series A-1, Series B, Series C, Series D, Series E, and Series F convertible redeemable preferred shares, which was recognised as a financial liability at fair value through profit or loss. Such changes are non-cash in nature.

As at 31 December, there are no more convertible redeemable preferred shares.

Segment-wise, revenue from the specialty pharmacy business increased due to the expansion of our pharmacy storefronts from 91 as of December 31, 2021 to 96 as of December 31, 2022, together with growing market demand.

Revenue from the health insurance services business increased due to further business development on enterprise clients and the launching of more Hui Min Insurance plans in different cities.

The gross margin for the specialty pharmacy business slightly decreased in 2022, mainly because of the change in the product structure. The decrease has been partially offset by the increase in the gross margin for health insurance services.

Net cash on hand was RMB1.46bn. Sipai has no debt.

Sipai expects to "generate net cash from our operating activities, through the sales revenue of our future commercialized products. Going forward, we believe our liquidity requirements will be satisfied by using funds from a combination of our cash and cash equivalents and net proceeds from the Global Offering."

Net proceeds from the Offering was HK$120.4mn.

Net cash used in operating activities was approximately RMB182.1mn in 2022.

As of December 31, 2022, Sipai has no other plans for material investments and capital assets.

Subsequent event. On January 6, 2023, Sipai entered into a share purchase agreement with Sinopharm Group Hubei (a subsidiary of SOE Sinopharm Group Co Ltd H (1099 HK)) to acquire an additional 45.00% equity interests in Sinopharm Holdings Smart Pharmacy (Hubei) Co., Ltd. for RMB3.2mn. This takes its stake to 80%.

This entity is primarily engaged in the retail of drugs and pharmaceutical products in Hubei Province.

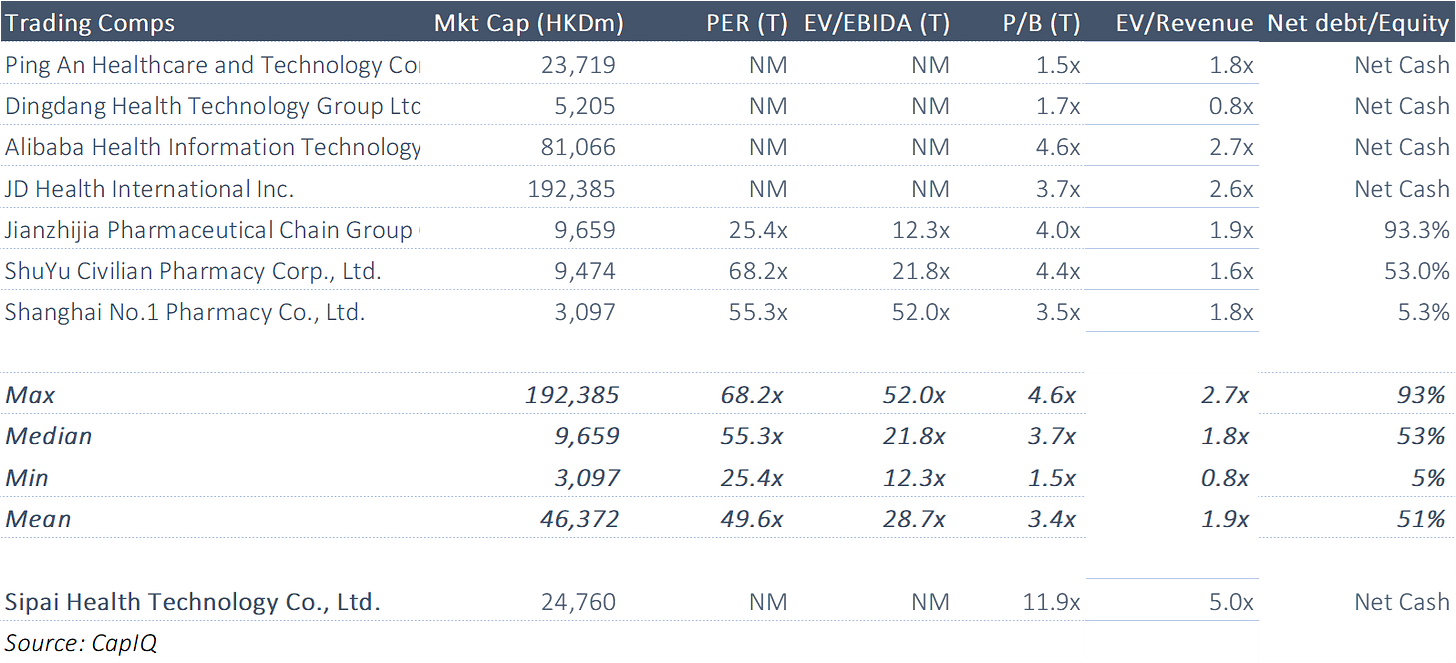

Versus Peers

Based purely on P/B and EV/rev metrics, Sipai appears expensive.

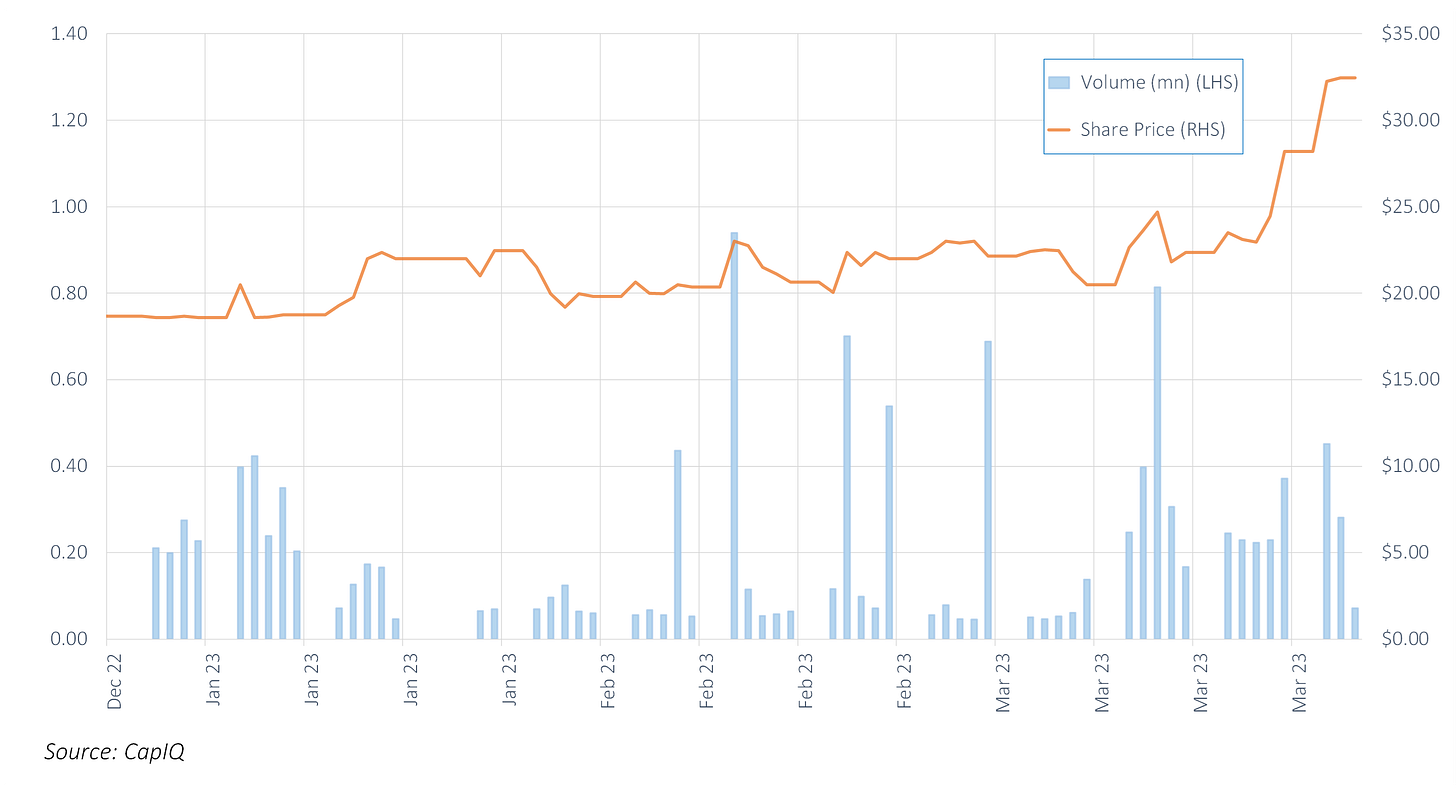

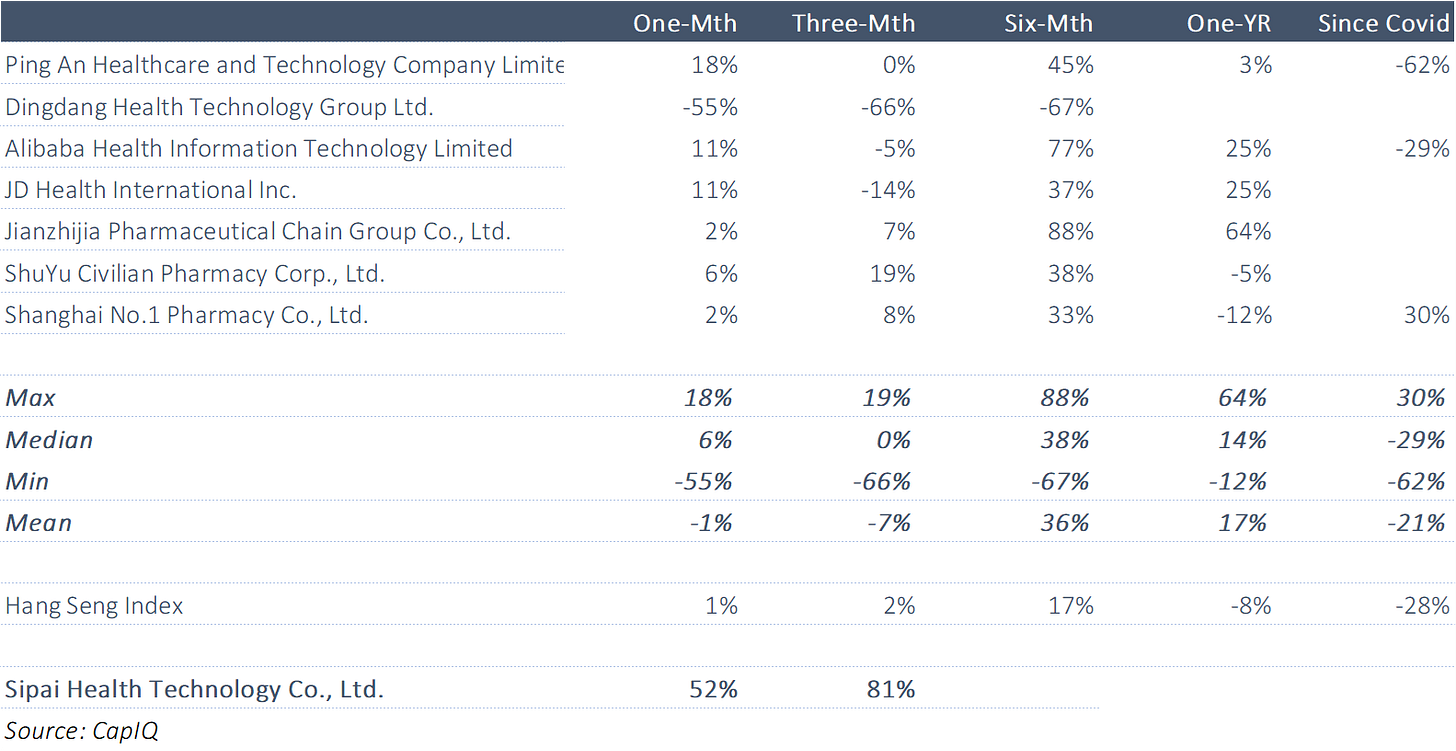

Price Performance

Shares are up 74% from its IPO price.

It closed up 34% on the first day of trading.

Since listing three months ago, Sipai has been an outperformer.

Anything Else?

Sipai is not shortable.

Just 32k shares are held via the Shanghai Southbound Connect Program; and 428.8k (0.06%) via the Shenzhen program. I'm surprised both are so low.

Conclusions

It is early days for Sipai.

No doubt pre-IPO investors, and those who were sounded out during the roadshow, were well-versed with the FY2 results.

This is an exciting area of medicine, and Sipai is a market leader in its key segments.

What is fair price though, is up for debate.

From a multiple of sales (5x+ for EV/sales and market cap/sales) standpoint, Sipai appears fully-priced with respect to peers.

And its forward revenue growth of 24% (just one broker) compares to the peer basket's average forward revenue growth of 26%.

Liquidity is an issue as only ~1.5% of total issued shares were free to trade following the global offering. Expect shares to get pushed and pulled depending on the interest/volume.

Lock-up for pre-IPO investors and other "existing shareholders" is 6 months.

As such, I would be cautious investing here given the vast overhang before June-end.

This has the potential to be a disaster for the share price, but it is tough for investors to prepare because the stock is not short-able.

For the above reasons, this insight is bearish.