Shengjing Bank (2066 HK): Another Rural Commercial Bank Delisting

In Chinese RCBs: Two Bailouts. How Many More At Risk?, I concluded Shengjing Bank (2066 HK) was one bank I would avoid. It's now suspended pursuant to the Takeovers code.

Shengjing Bank had one of the largest P/B and net income declines in recent years. It had borderline allowance/provision coverage. It also had the lowest net interest margin.

Shengjing Bank is PRC-incorporated, therefore any delisting proposal would involve a Merger by Absorption, incorporating a Scheme-like vote. And probably a tendering condition.

Shengjing Bank is super illiquid - look away now if this is not your thing.

Shengjing Bank is also suspended, so there is nothing to be done right now.

Some Background

Shengjing Bank was listed on the HKEx on the 29th December 2014 at HK$7.56/H-share.

Here is the prospectus.

Shengjing Bank is a rural commercial bank in China, primarily serving the local economy, focusing on local businesses, small and medium enterprises, and urban/rural clientele.

Loan exposure: high real estate exposure due to Liaoning’s urban centers. Agricultural lending is present but secondary.

Geographical exposure: Liaoning province (northeastern China).

Northeastern China (Liaoning, Jilin, Heilongjiang) have been noted (in the past from S&P) for economic stagnation, and higher NPLs.

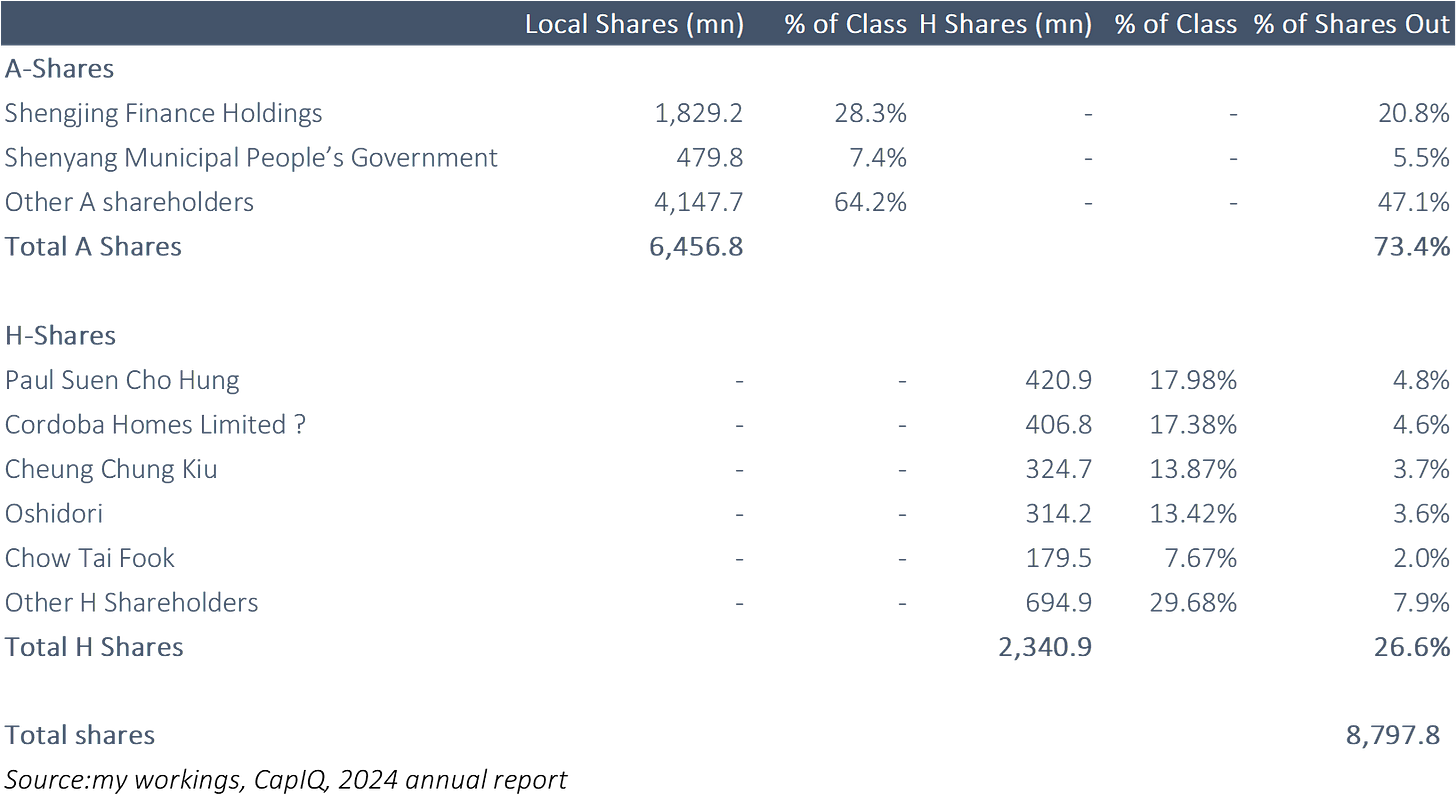

Who owns what? Shengjing Bank is primarily owned by state-owned entities and institutional investors via the A shares.

By the numbers. FY24 net profit declined 15.3% yoy to RMB621mn.

A reasonable allowance/provision coverage ratio range for RCBs is 150%-200%. Shengjing Bank's was borderline.

As pointed out in Chinese RCBs: Two Bailouts. How Many More At Risk?, had the lowest net interest margin of a basket of RCBs, and the largest net income decline in FY24.

Keep reading with a 7-day free trial

Subscribe to Hong Kong/China M&A/Events to keep reading this post and get 7 days of free access to the full post archives.