Shandong Chenming Paper (1812 HK): The H/B Convergence Trade

B-shares - remember them?

Created in 1992 to attract foreign investors, their introduction, which followed the launch of A-shares, was a precursor to wider market access reforms for foreigners, as China integrated itself with the global economy.

Fast forward and years of market liberalisation provide foreign investors access to 3,000+ companies with A-shares. As a result, the combined market value of B shares accounts for less than 0.2% of the capitalisation of A-shares issued by companies in Shanghai. More importantly, the average daily trading volume for B-shares is ~0.1% of its peers.

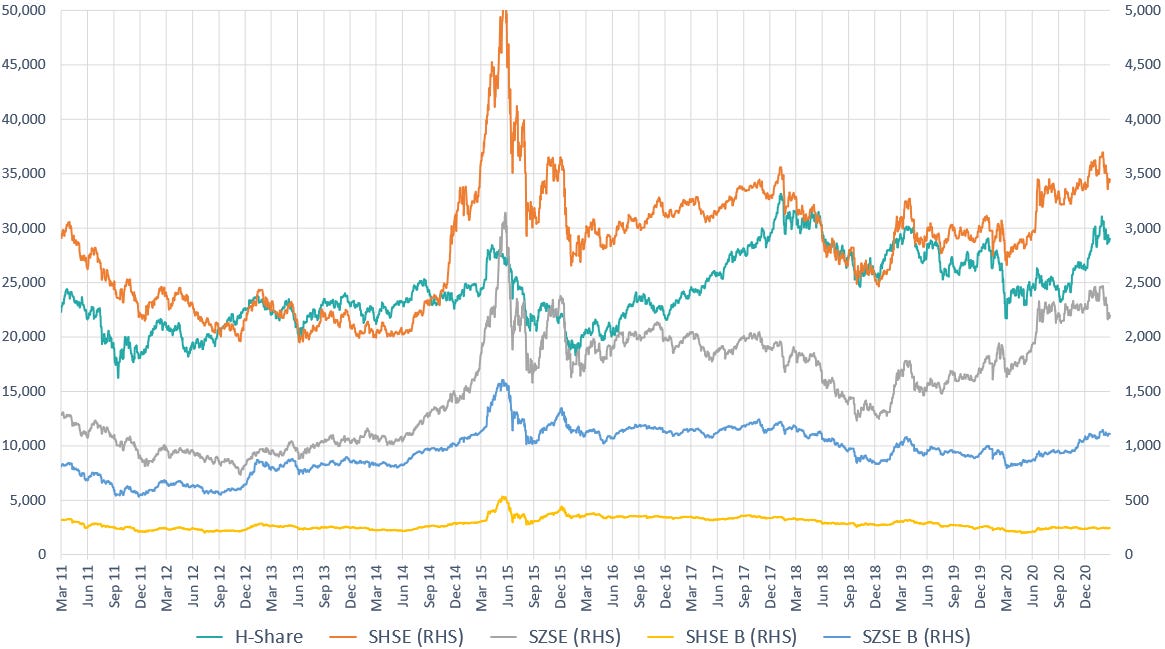

Over the last decade, the HSI is up 30%. The Shanghai Exchange is up 18%, whereas the Shanghai B-share index is down 22%. For Shenzhen, the main index is up 70% versus 37% for the B-share index.

Source: CapIQ

B shares have become a sort of zombie market for foreigners.

The authorities could merge the B and A shares, which would result in a spike in the Bs, given their historical trading discount.

Alternatively, B shares can be transferred into H-shares for trading on the Hong Kong exchange, as seen in China International Marine Cntnrs Gp (2039 HK), China Vanke Co Ltd (H) (2202 HK), and Livzon Pharmaceutical Group (1513 HK).

The New News

On the 29 January 2021, Shandong Chenming Paper A (000488 CH)/(1812 HK) announced the proposed listing of its domestic (B-shares) on the Hong Kong Stock Exchange, as H-shares. The circular is here, and shareholders approved the transfer on the 9 March.

B-shares closed yesterday at HK$5.49/share. Yet the H-shares - in which the B-shares will be converted into - are trading at HK$6.70/share.

More below the fold ...

Keep reading with a 7-day free trial

Subscribe to Hong Kong/China M&A/Events to keep reading this post and get 7 days of free access to the full post archives.