MINISO (9896 HK)'s (Possible) TOP TOY Spin-Off Is Priced In

Three months ago, local media reported that Chinese lifestyle retailer MINISO Group Holding (9896 HK) was considering spinning off its collectible toy unit TOP TOY on the Hong Kong exchange.

Reportedly, MINISO could raise ~US$300mn from an IPO. MINISO has now confirmed that a spin-off is being contemplated; although a proposal is only at a preliminary stage.

TOP TOY has been a growth engine. But its contribution to the group is still ~6%. Applying a holding company discount, post spin-off, MINISO's upside appears limited.

The Trade:

The spin-off plan is preliminary in nature.

A spin-off makes sense: TOP TOY’s has been a standout in MINISO’s portfolio, and a separate listing would enable MINIDO to focus on its lifestyle goods.

However, I see MINISO trading at a 21% discount to NAV. Before any holding company discount. I question how much juice is left in the trade.

This insight is labelled bearish as I'm not bearish here.

The NEW News

MINISO has confirmed that it is:

making preliminary assessment on the possibility of a potential spin-off listing of its pop toy business operated under the brand “TOP TOY”

That's it.

On TOP TOY

This division has been going gangbusters.

But so has MINISO's core-branded stores.

As at 31 Dec 2024, TOP TOY stores (directly operated + stores operated by partners [which comprise the majority]) expanded 87% yoy to 276, up from 148 in FY23.

As a comparison, MINISO stores increased 17% yoy to 7,504 from 6,416 in FY23.

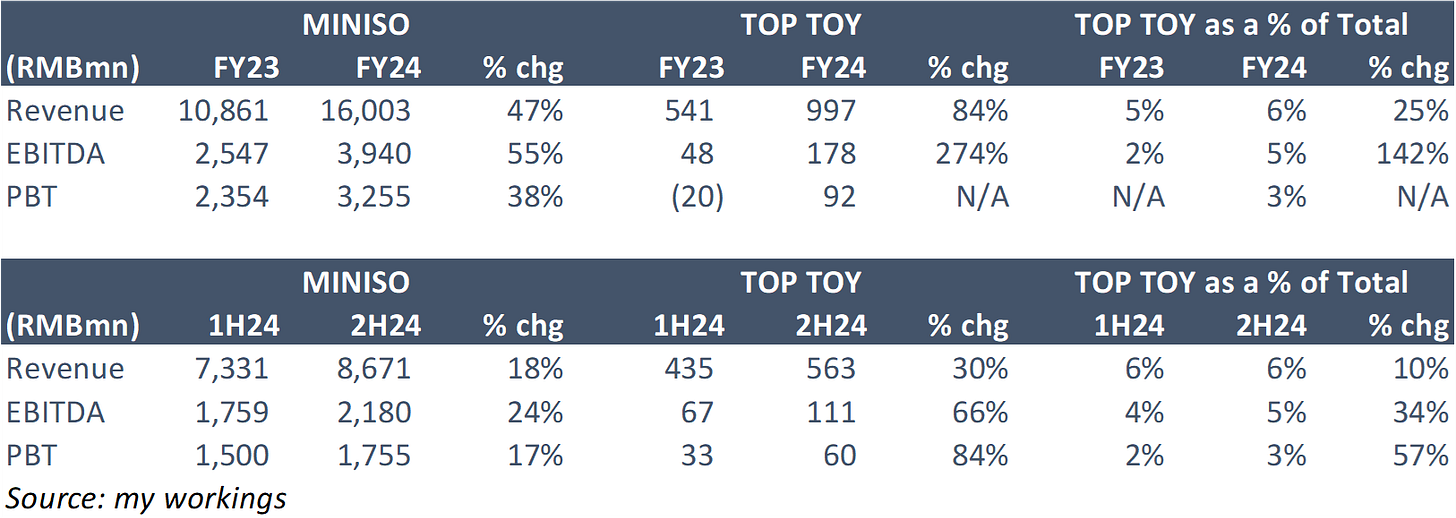

TOP TOY's segment revenue and EBITDA was RMB997mn and RMB178mn, respectively, up 84% and 274% yoy.

As a comparison, MINISO segment revenue and EBITDA was RMB16bn and RMB3.9bn, respectively, up 47% and 55% yoy.

The upshot: MINISO stores are growing; TOP TOY's are growing faster. But remain a small % of the overall group.

Keep reading with a 7-day free trial

Subscribe to Hong Kong/China M&A/Events to keep reading this post and get 7 days of free access to the full post archives.