Hanergy's Hobson's Choice

On the 23 October last year, the Board of Hanergy Mobile Energy Holdings Group Limited (HMEH), Hanergy Thin Film Power (566 HK)'s majority shareholder, announced an intention to privatise the company at "no less than HK$5/share" via cash or scrip. Over a full week later, Hanergy acknowledged the proposal.

Following this privatisation, Hanergy would be listed on China's A-share market. The indicative offer valued Hanergy at ~US$27bn. Hanergy has been suspended since 20 May 2015 and last traded at $3.91/share.

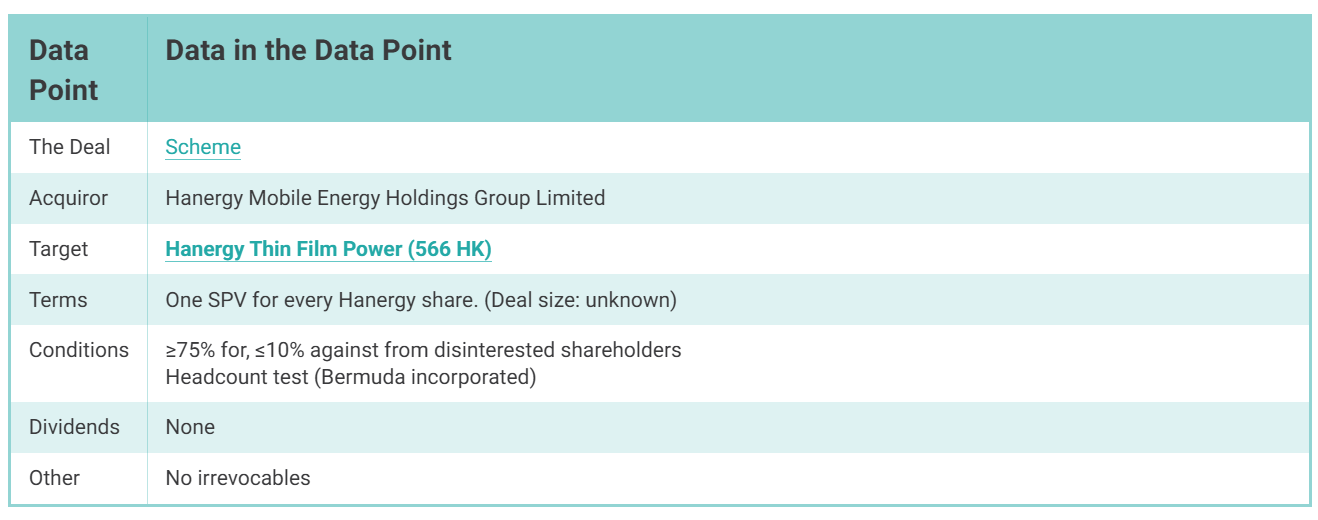

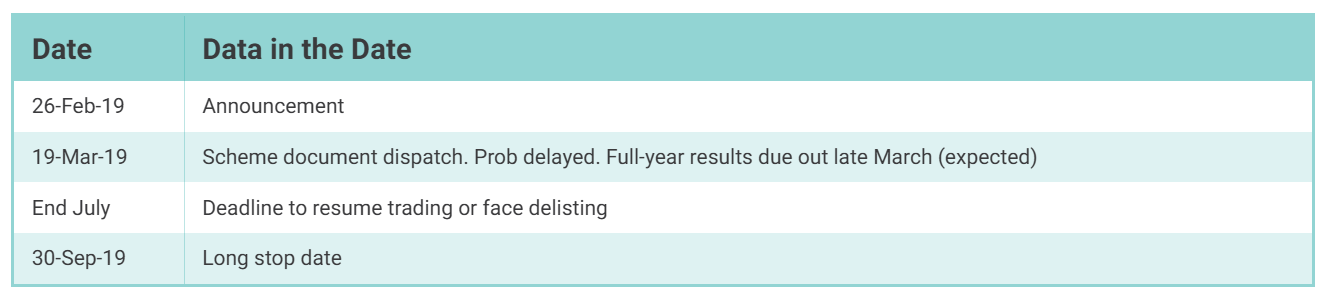

Hanergy has now announced the intention of HMEH to privatise the company by way of a Scheme. The ultimate intention of HMEH still remains the listing of Hanergy's business in China.

The rub is that the consideration under the Scheme will be in the form of one special purpose vehicle share (SPV) per Hanergy share. To this:

it is not certain whether the A-Share Listing can be achieved. If the A-Share Listing cannot be completed, the Independent Shareholders will be holding onto unlisted SPV Shares for which there is no exchange platform for transfers. Even if the A-Share Listing is completed, there is no certainty as to

(a) when and how the SPV will be able to dispose of the A-Share Listco Shares;

(b) at what price the A-Share Listco Shares can be sold; and

(c) when the cash exit can be available to the Independent Shareholders, via the proposed A-Share Listing.

Upon consultation with the Executive and given the above uncertainties, the Offeror is required not to attribute any monetary value to

(i) the Proposal and

(ii) any potential cash exit for the Independent Shareholders.

The announcement does not stipulate the jurisdiction of the SPV, only that it may be established in a jurisdiction apart from Hong Kong. That itself is a risk.

Long-suffering shareholders, who comprise 32.49% of shares out, have the dubious honour of holding SPV shares which may remain in A-share pre-listing purgatory; or should the Scheme fail/lapse, hold unlisted shares if Hanergy fails to resume trading by end-July 2019, as per recently introduced HKEx guidelines. Such an outcome affords HMEH the flexibility to squeeze out minorities at a bargain price.

(A Hobson's choice is a free choice in which only one thing is offered. In this instance, each outcome is undesirable.)

With Hanergy suspended, there's not a lot investors can do. This insight provides an overview of the Scheme and a brief recap of the new delisting guidelines.

The Scheme

Source: Offer announcement

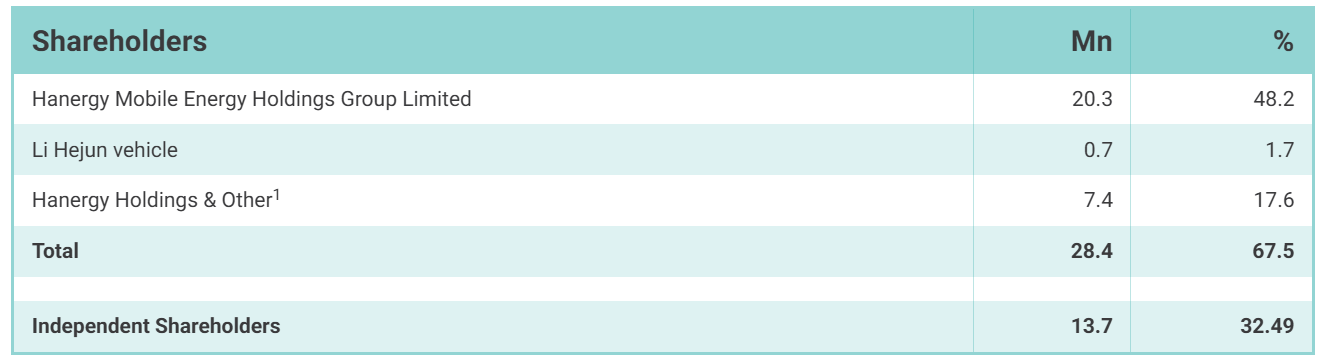

Source: Announcement, Other1 is a Li Weijun's vehicle, Li Hejun's brother

The SPV

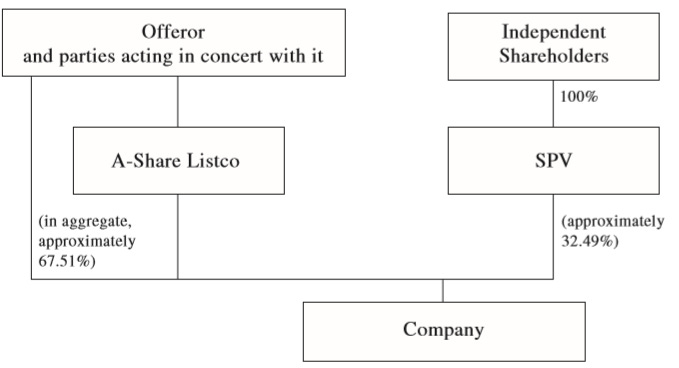

Upon the Scheme becoming effective, the SPV will be wholly-owned by the independent shareholders as shown below:

The SPV may be established in a jurisdiction apart from Hong Kong, but will be incorporated in a jurisdiction outside the PRC. Therefore the jurisdiction may not provide the same level of minority protection rights as in Hong Kong. Furthermore, such jurisdiction may not provide the same protection as Bermuda law, should Hanergy's shares be delisted under the Listing Rules, provided the Scheme fails.

The A-share listing steps are detailed on pages 24-27. The process is overwrought with numerous variables, and for the benefit of readers, it is probably best to reiterate the conclusion that:

Shareholders and potential investors should be aware that none of the Offeror or parties acting in concert with it, the SPV, the Company and BaoQiao Partners will give any guarantee of whether, when and how the A-Share Listing, including but not limited to A-Share Listing group structure, size and method of pre-IPO and IPO fundraising, etc. can be achieved.

If the A-Share Listing cannot be completed, the Independent Shareholders will be holding onto unlisted SPV Shares for which there is no exchange platform for transfers.

Delisting In Any Event

For what it's worth, if the Scheme is not approved or lapses, the Offeror is restricted from making another Offer within 12 months from the date on which the Scheme is not approved or lapsed.

If Hanergy cannot resume trading before the end of July 2019, in accordance with the Rule 6.01A(2)(b) of the Listing Rules, Hanergy will start a delisting procedure. (Please refer to my prior insight for more detail.)

This would be a GREAT outcome for HMEH. Mandatory delisting would enable it to squeeze out minority shareholders, absent a market for their shares and necessary Listing rules (& Rule 2.2 of the Takeovers Code) disclosures, at a bargain price.

Bermuda Law & Minority Squeeze Out

Should Hanergy's Scheme fail and it is delisted in accordance with the new listing rules, the company will still be subject to the Bermuda Companies Act. Minority squeeze out can take place under:

Section 103, wherein shareholders holding not less than 95% of the shares in a company may give notice to the remaining shareholders of the intention to acquire their shares on the terms set out in the notice.

By an amalgamation under Sections 104 to 109, wherein the statutory threshold for approval is 75% of shareholders voting at the meeting - therefore HMEH just needs another 7.5% of shares out - at which a quorum of two persons at least holding or representing by proxy more than one-third of the issued shares is present.

Any shareholder who did not vote in favour of the amalgamation and who is not satisfied that he has been offered fair value for his shares may apply to the court for an appraisal of the fair value of his shares.

The court will look to shareholders as a whole and not simply in respect of an individual shareholder. The onus is on the dissenting shareholder to convince the court, which is made more challenging depending on the % of shareholders who have accepted a proposal.

This insight is labelled bearish as it has to be labelled something. The continued suspension of the company, and the SFC's motives for that suspension, adequately sum up the company.