CR Power (836 HK): Upside From Clean Energy Spin-Off

Late March, SOE-backed power play China Resources Power Holdings Co Ltd. (836 HK) announced it intends to spin off its energy unit via an A-share listing.

Shares gained 4.9% on the news - gains which were promptly given back over the ensuing fortnight.

Renewable energy profits have been the driving force behind CRP's bottom line strength the last two years. But how best to assign a value to the remaining loss-making thermal ops?

The NEW News

On the 23 March, CRP announced it was considering a proposed spin-off and listing of China Resources New Energy Group Company Limited (CRNE) by way of an initial public offering and listing of A shares.

Wholly-owned CRNE operates CRP's wind and photovoltaic power (read solar) business.

CRNE does not include CRP's hydro business, which accounts for ~2% of the attributable operational generation capacity under its renewable energy segment.

CRP's intention is to continue to consolidate CRNE.

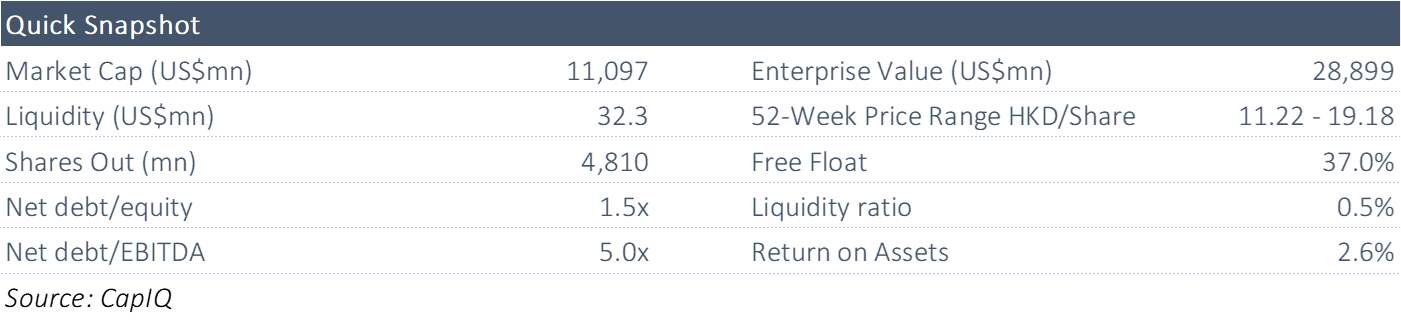

On China Resources Power

As at the end of 2022, CRP had an operational generation capacity of 67,814MW and attributable operational generation capacity of 52,581MW, out of which, the attributable operational generation capacity of thermal power plants amounted to 35,577MW or 67.7%.

The total attributable operational generation capacity of wind, photovoltaic, and hydro power projects amounted to 17,004MW or 32.3%.

CRP was listed on the 12 November 2003 at $2.80/share.

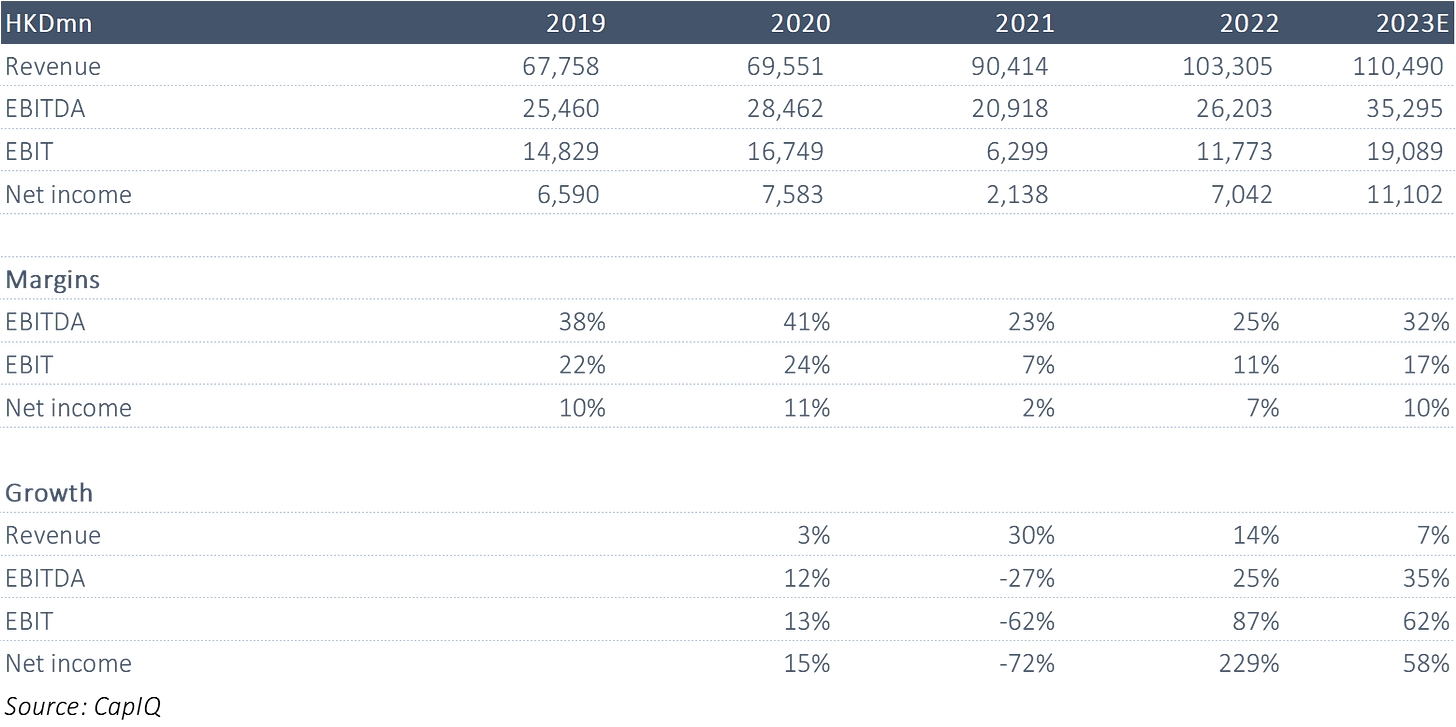

Abridged Financials

The Recent Results

For FY22, profit was HK$7,042mn, up from HK$2,138mn in 2021.

Core profit contribution from the renewable energy business amounted to HK$8,645mn (2021: HK$8,926mn), and core loss attributable to the thermal power business amounted to HK$2,582mn (2021: loss HK$5,942mn).

A final dividend of HK$0.376/share was declared. The full-year divy was HK$0.586 per share, representing a dividend payout ratio of 40%.

Shareholder Register

CRP is 63.99% held by SOE conglomerate, China Resources Holdings.

A Brief Overview of Ops

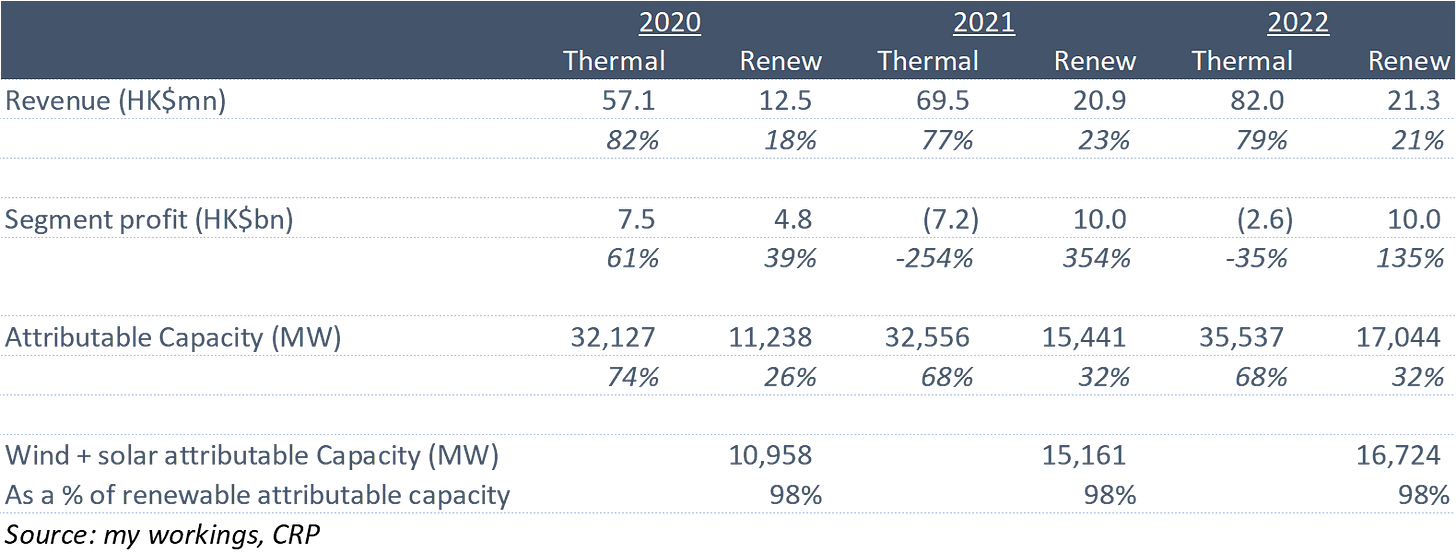

The following table shows the segment results, and attributable capacity for each segment.

Fuel costs ate into thermal profitability the last two years.

The attributable operational generation capacity of wind power was 15,512MW. It was 1,212MW for solar.

In 2022, CRP obtained new approvals (or filed) for 6,670MW of wind power projects and 18,260MW of photovoltaic power projects.

Currently under construction includes 4,584MW for wind power, and 5,604MW for solar.

As per the 2022 annual report (page 57), in "the 14th Five-year Plan period, CRP aims to increase its installed capacity of renewable energy by 40GW. It is expected that the mix of installed capacity of renewable energy will exceed 50% by the end of the 14th Five-year Plan period (i.e. the end of 2025)".

That seems like a lot - I wonder if the intention is to increase "to" 40GW, not "by".

The grid connection target for new wind and photovoltaic power projects for 2023 is expected to be 7,000MW.

Deja Vu

Back in January last year, JPM discussed CRP spinning off its renewable business - in the mainland - and raising US$1-2bn in process.

Bloomberg also carried this news a month later, but with an HK listing.

ABC International Holdings and China International Capital Corporation allegedly had been selected to help with the listing,

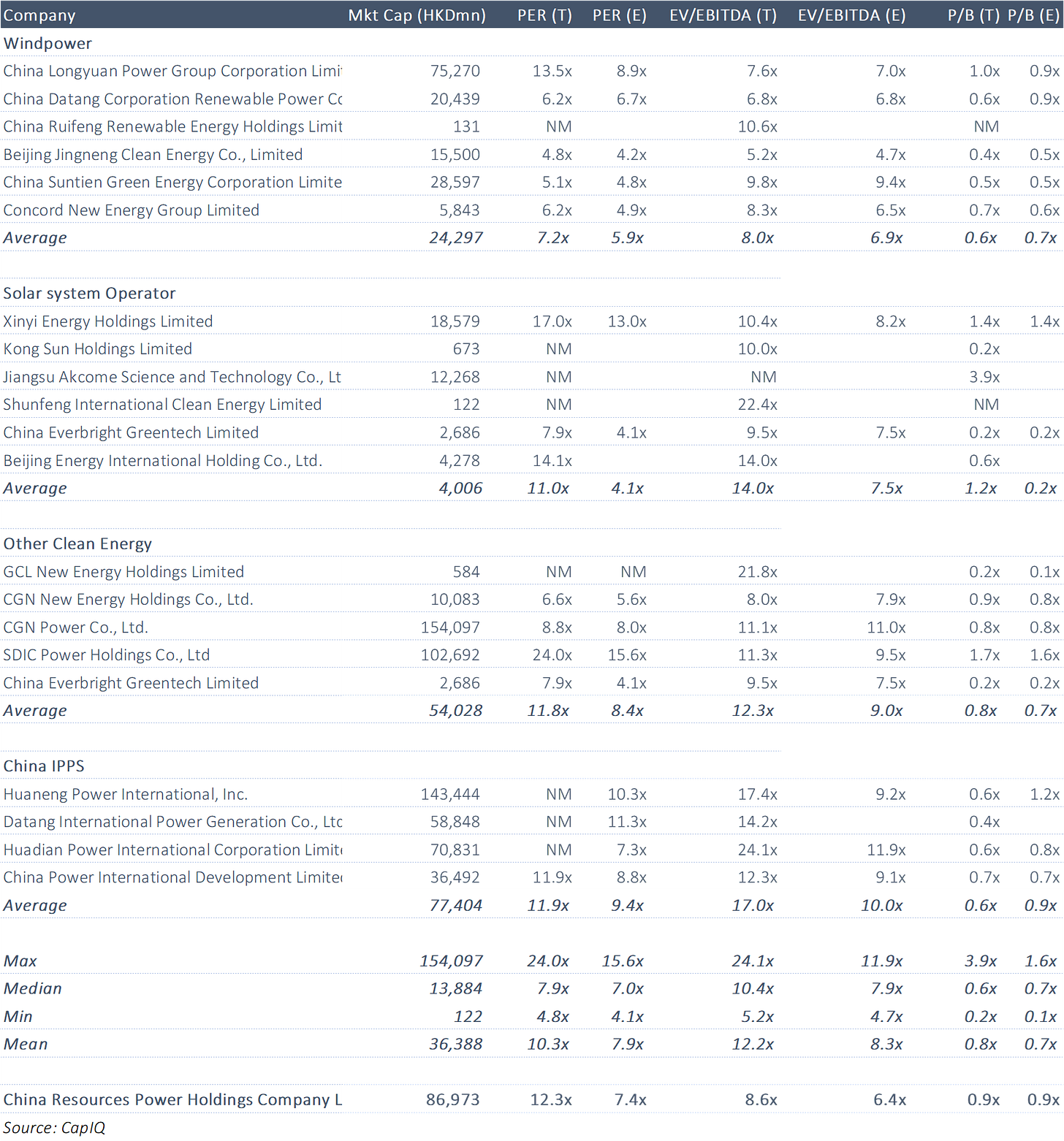

Versus Peers

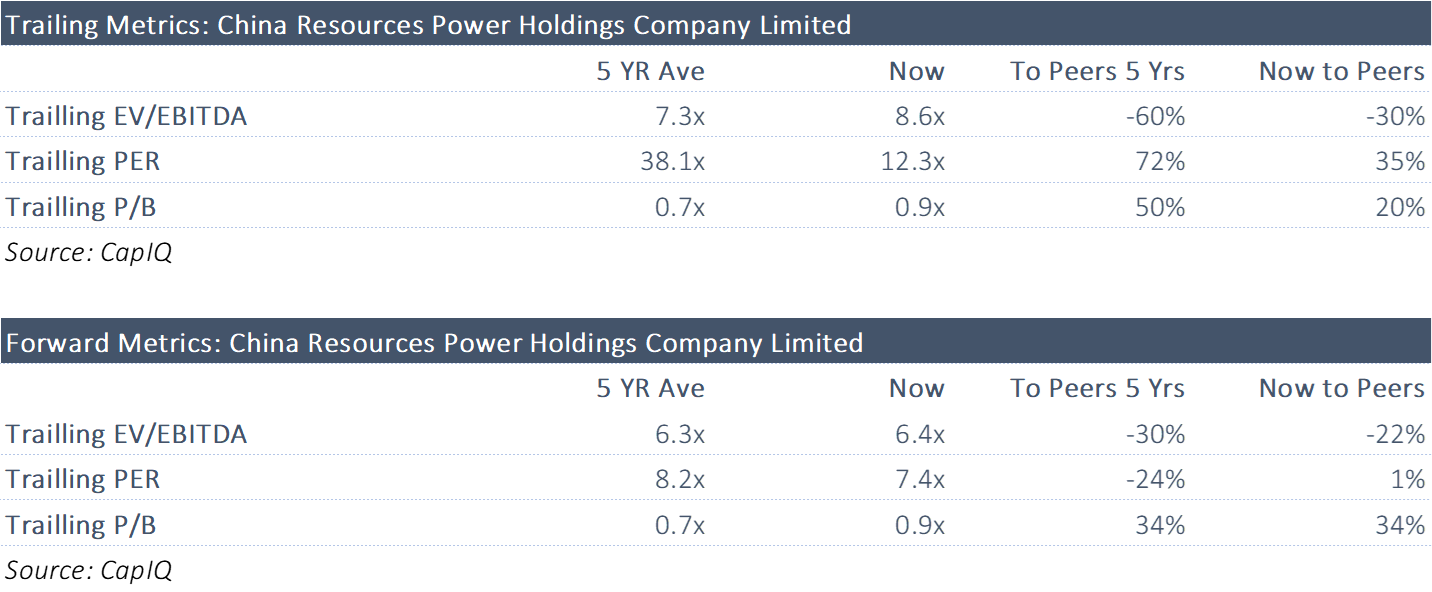

On forward metrics, CRP doesn't appear overly expensive, except on a P/B metric.

Compared to the past five years, CRP is generally more expensive to the average, and to peers (using just the IPPs here), on a trailing basis.

On a forward basis, CRP is generally up on its average and versus peers (again, using the IPP peers).

Price Performance

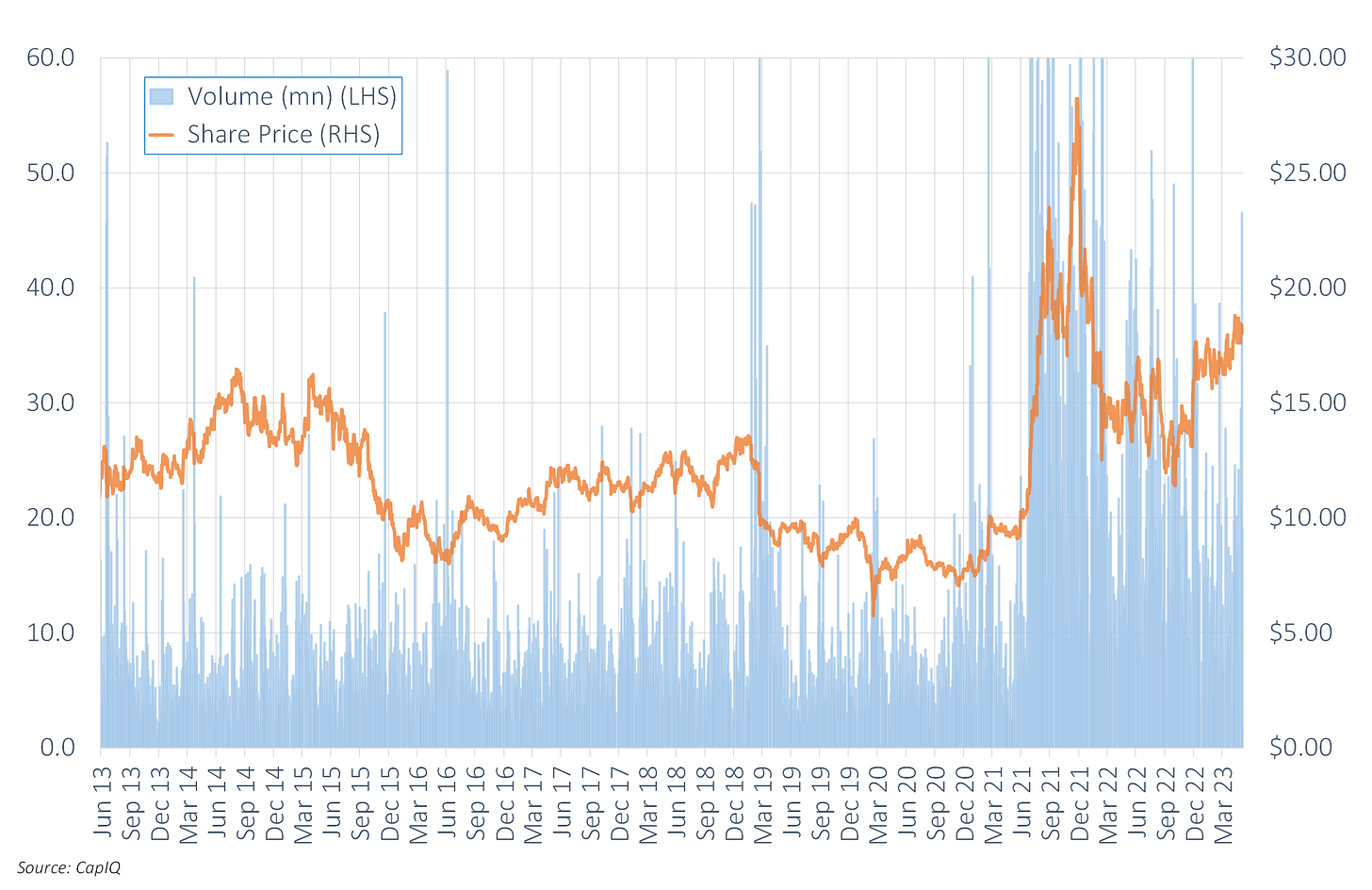

CRP's share price took off late 2Q21, peaking in December before rolling over.

Shares have been trending up since the recent low last November.

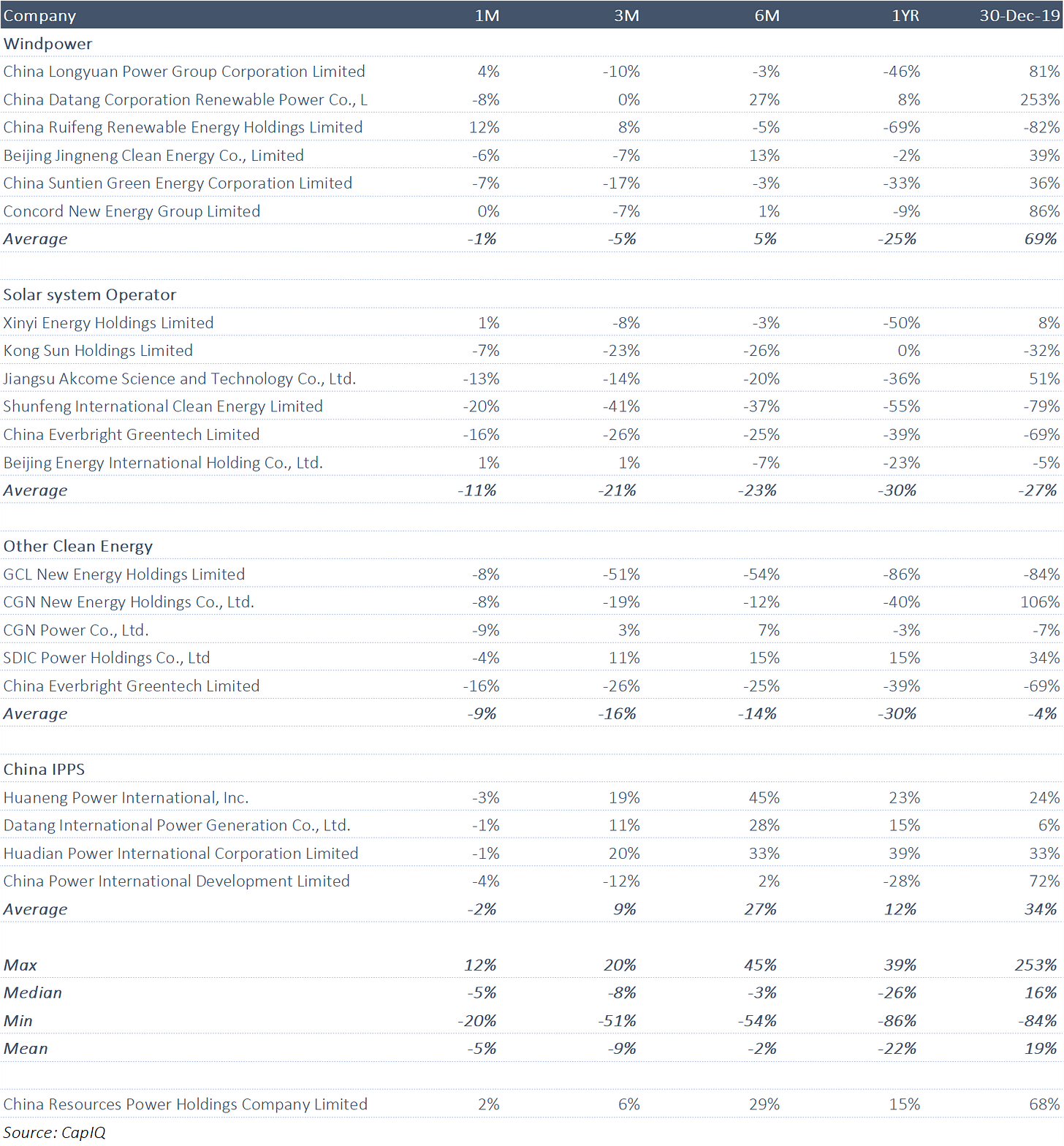

CRP is up against a basket of peers, including the IPP peer average.

Anything Else?

Short interest is just 0.44% of shares out, and has been trending down since late last year.

7.7% of shares out are held via the Shanghai Southbound Connect program, marginally up year-on-year.

6.33% of shares out are held via the Shenzhen Southbound Connect program, flat year-on-year.

I see no large CCASS movements over the last year.

So - What Is A Fair Value?

I don't see a huge amount of listed PRC new energy plays - if excluding hydro, nuclear (which I consider green-ish), and waste energy.

Those that do appear, such as Jiangsu Akcome Science & Technlgy (002610 CH) and SDIC Power Holdings (600886 CH), do command higher metrics than HK-listed peers.

A few assumptions need to be made. IF assuming 15x forward multiple for the renewable energy segment, and 15% of the Spin-Off Co is spun off (via the issuance of new shares), that could be worth ~HK$110bn to CRP for its 85% stake.

The thermal ops are loss-making. Assigning a (very loose) P/sales of 0.6x , roughly in line with IPPS, backs out another HK$50bn.

This seems a reasonable figure. The thermal ops had a normalised profit margin of around 6-7% in 2019-2020, and the IPPs trade at 10x PER.

IF assigning a 30% holding company discount, this could suggest 30% upside for CRP here.

Conclusions

CRP is renewing the listing of its renewable energy unit. This time around, we have firm confirmation from the company.

Given this unit's profitably, such a listing should be a significant event, attracting a wide audience, and possibly (probably) a premium to other listed green energy plays.

This is positive to CRP.

There remains a question mark on timing, how best to value CRP's loss-making thermal operations, and what is a suitable holdco discount.

CRP is not trading rich to peers.

On balance, and on the expectation we see additional newsflow on the spin-off, CRP should outperform its IPP peers.